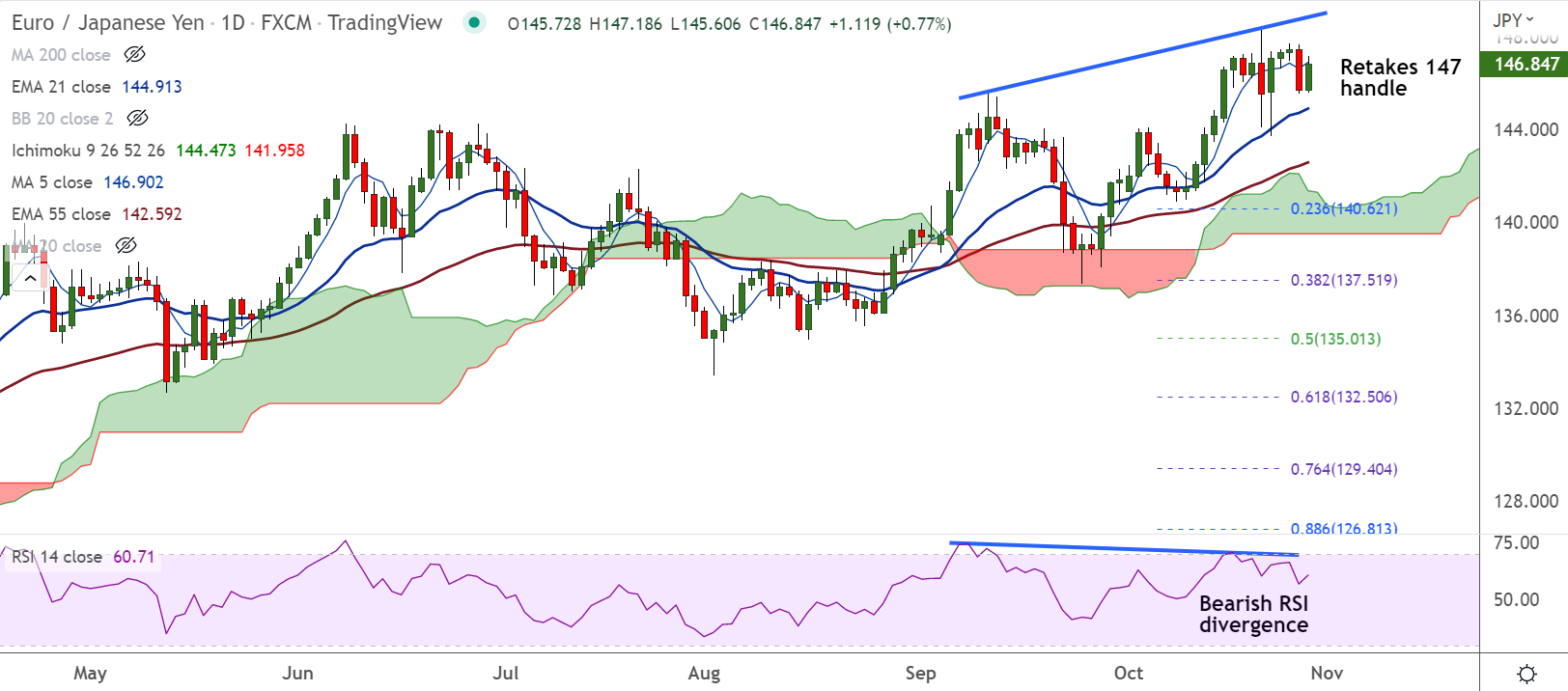

Chart - Courtesy Trading View

EUR/JPY erased most of the previous session's losses and rallied past 147 handle after BOJ’s dovish rhetoric and Japan’s stimulus news.

Bank of Japan’s (BOJ) status-quo at its monetary policy meeting along with the dovish rhetoric from Governor Haruhiko Kuroda revived the yen selling.

Kuroda speaking at the post-policy conference said that rapid yen moves are negative, undesirable for Japan’s economy.

He added that yield curve control is unlikely causing yen weakening and reiterated that the BoJ “won't hesitate to ease monetary policy further if necessary.”

On the other side, Eurozone's Final Consumer Confidence Index matched market expectations at -27.6 in October vs. -28.8 recorded previously.

Meanwhile, the bloc’s Economic Sentiment Indicator for October dropped to 92.5, also inline with expectations and 93.6 previous.

Support levels - 144.91 (21-EMA), 144.67 (20-DMA)

Resistance levels - 146.90 (5-DMA), 148.95 (Trendline resistance)

Summary: EUR/JPY trades with a major bullish bias. Pullbacks have found support at 21-EMA and any major weakness only on break below. Resumption of upside will see test of trendline resistance at 148.95.