• EUR/NZD rose higher on Friday as broad risk aversion and lower commodities prices weighed on kiwi dollar.

•Copper prices hit their lowest levels in more than three months on Friday due to the absence of stimulus measures from top consumer China.

•Iron ore futures prices fell and were on track for a weekly loss as weak seasonal demand for steel weighed on the market.

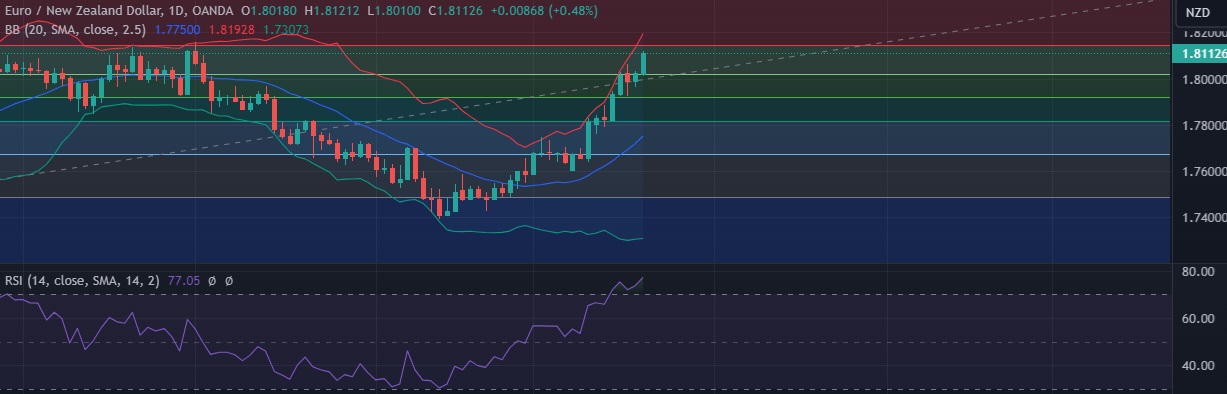

• Technical signals are strongly bullish: daily momentum studies and the 5, 9, and 11 DMAs are trending upward, while the RSI is heading north at 77.

• Immediate resistance is located at 1.8147 (23.6%fib), any close above will push the pair towards 1.8185 (Higher BB).

• Strong support is seen at 1.8013 (38.2% fib) and break below could take the pair towards 1.7923 (38.2% fib )

Recommendation: Good to buy around 1.8080, with stop loss of 1.7950 and target price of 1.8150