- EURUSD pared its gain after hitting 27 month high at 1.20704 level. USD got strengthened slightly after better than expected US consumer confidence. US conference board consumer confidence came at 122 compared to forecast of 120 better reading since 2000.

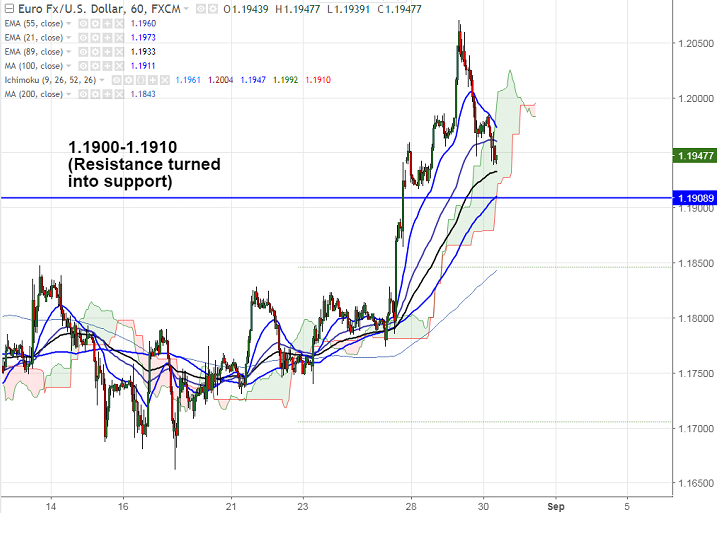

- The pair broken the yesterday low of 1.19465 and dipped till 1.19385 at the time of writing. The near term intraday support is around 1.19300 (89- H EMA) and any break below will drag the pair down till 1.1908/1.1845 (200- H MA).

- On the higher side, 1.1963 (hourly Tenkan-Sen and 55- H EMA) will be acting as near term intraday resistance and any break above will take the pair till 1.2000/1.2070 (161.8% retracement).

It is good to buy on dips around 1.19050-1.1910 with SL around 1.1845 for the TP of 1.2000/1.2070.

Resistance

R1- 1.20704

R2 1.2100

R3- 1.2185

Support

S1-1.19100

S2-1.1845

S3-1.1770