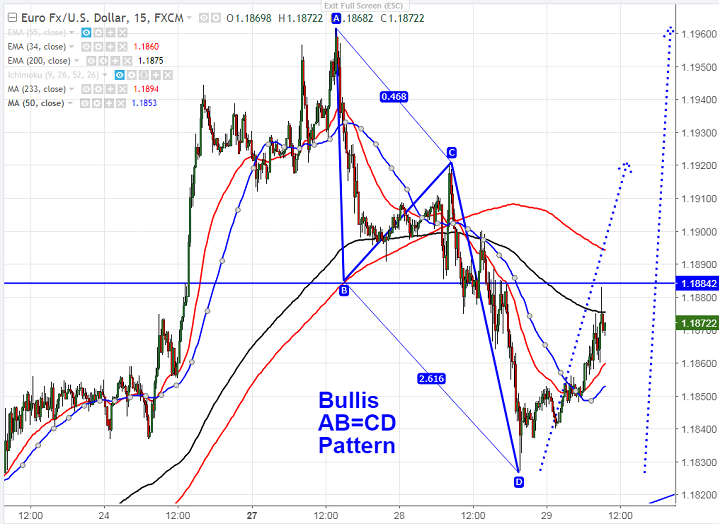

- Harmonic Pattern formed – Bullish AB=CD pattern.

- Potential Reversal Zone (PRZ) - 1.18270

- EURUSD hits low of 1.18270 after Senate passes tax plan yesterday and shown a minor recovery of almost 60 pips ahead of German inflation data.

- The pair declined 140 pips after US tax reform bill passing budget committee and progress of the U.S tax bill through Senate will be key driver of US dollar.

- Market awaits German will release its prelim November inflation figures which is to be slightly higher than expected. US first revision of GDP and PCE inflation will be released today for further direction.

- Technically the pair is facing resistance at 1.18850 and any break above will take the pair to next level till 1.1928/1.19615.

- On the lower side, near term support is around 1.18250 and any violation below will drag the pair to next level till 1.18000/1.17730/1.1755 (50- day MA). It should break below 1.1700 for major weakness.

It is good to buy on dips around 1.1855-60 with SL around 1.1800 for the TP of 1.1928/1.2000.