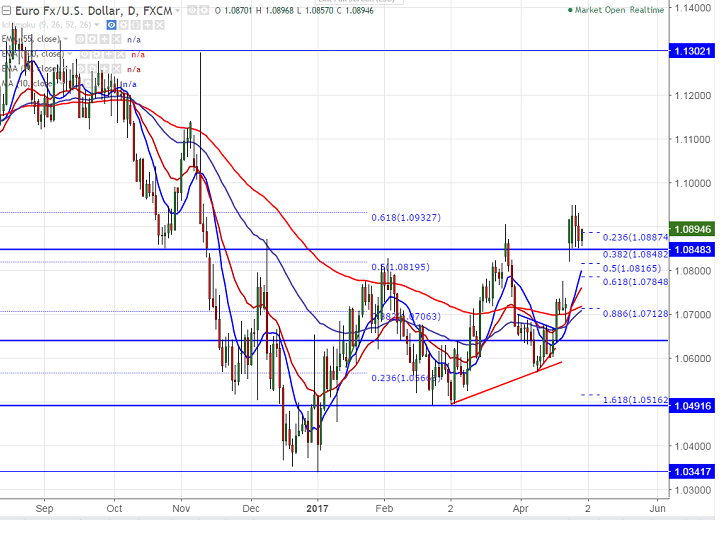

- EUR/USD shown a minor sell off after hitting high of 1.09328 yesterday. Euro declined from the temporary top as ECB Draghi dismissed policy normalization. Dovish Draghi comments pushes European bond yields lower. The pair declined till 1.08516 and is currently trading around 1.08925.

- On the lower side, any break below 1.08500 bottom formed after French election will drag the pair down till 1.08200/1.07850 (61.8% retracement of 1.06822 and 1.09508)/1.0745 (21 EMA).

- The near term major resistance 1.09500 and any violation above will take the pair till 1.1000/1.1045.The minor resistance is around 1.09329 (61.8% retracement of 1.1299 and 1.03400).

It is good to sell on rallies around 1.0900 with SL around 1.09520 for the TP of 1.08200/1.0785.

Resistance

R1-1.09500

R2 -1.1000

R3- 1.1045

Support

S1-1.08500

S2-1.08200

S3-1.07850