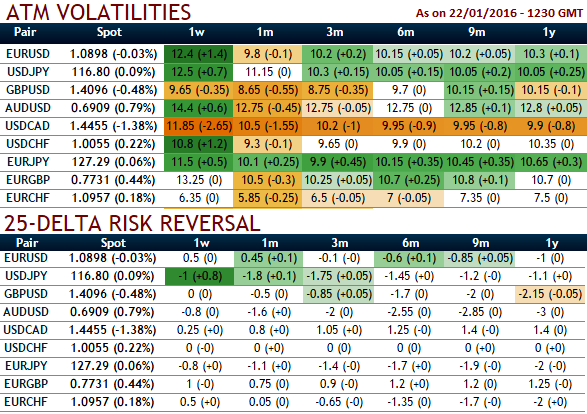

The implied volatility of ATM contracts for near month expiries of this the pair is at around 13.25% for 1W contracts which is second highest among G10 currency space.

It is very risky venture to hedge or speculate with naked contracts that may turn out to be a gamble on those currency pairs whose implied volatility would likely perceive higher IVs (from the nutshell one can observe, euro currency crosses except EURCHF are the ones whose IVs are increasing consistently).

It may fetch desirable outcomes for option holders but at times seems unlikely irrespective of mathematical computations due to any abrupt macroeconomic or geopolitical matters.

Hence a lot of spreads have been drawing up some customized strategies by using P&L tools and techniques while looking upon the option Greeks. While doing so it seems like the FX options involving euro have tons of Gamma.

It might be puzzling because on one hand it seems some of these options are highly volatile than any other euro currency pairs but a tiny shift in the underlying exchange rate would cause instant disaster.

For an instance, we've considered EUR/GBP's downside risks in short run (based on technicals), and this can be mitigated by devoting little time on ascertaining an accurate gamma.

We've constructed put spread by considering gamma somewhere closer to zero that would neutralize the implied volatility impact on option price.

This position remains quite firm to achieve our hedging objectives (we've used price band between 0.7752 - 0.7535), because we know gamma represents the change in delta, we still have healthier delta at -0.51.

This spread results in desired hedging objective irrespective of implied volatility disruptions as we have both ITM and OTM instruments on long and short side respectively and prevailing bear run will be taken by In-The-Money puts.

FxWirePro: EURGBP gamma spreads to optimize through HY IVs

Friday, January 22, 2016 8:42 AM UTC

Editor's Picks

- Market Data

Most Popular