EURGBP consolidating after ECB rate cut. It hit a low of 0.84361 at the time of writing and is currently trading around 0.84434.

ECB cuts rates by 25 bpbs as widely expected. The central bank projects inflation higher to 2.9% in 2024 and growth revised down to 0.8% in 2024.

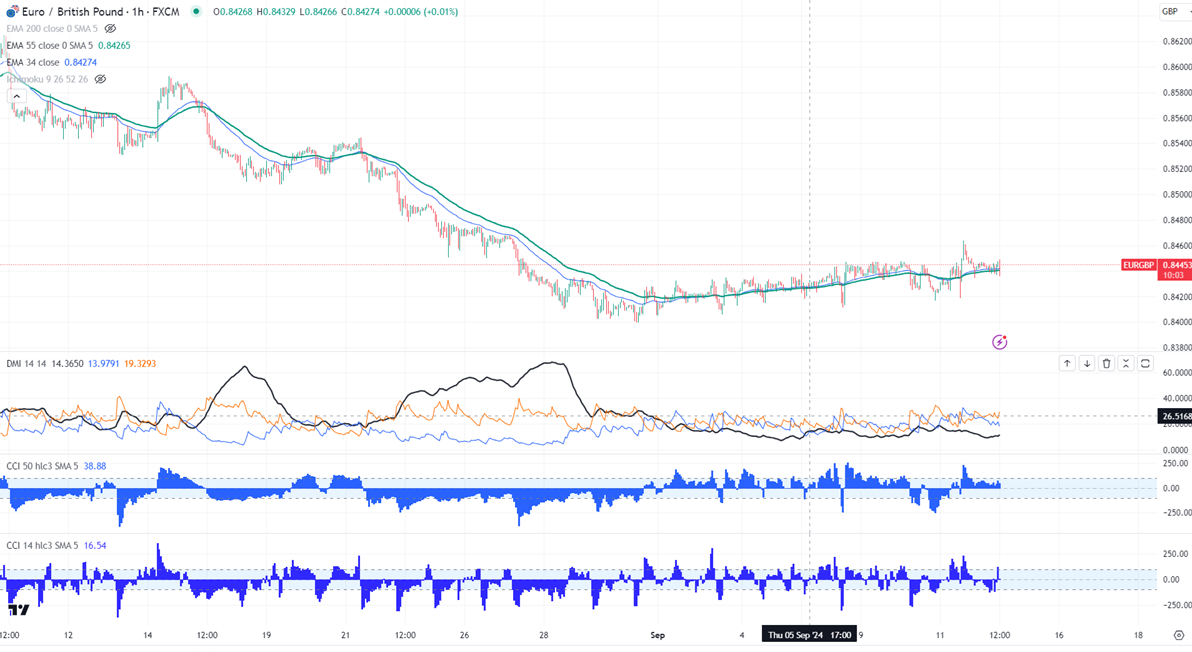

Technicals-

Intraday trend is neutral.

The pair is trading above 34- and 55 EMA in the 1-hour chart.

The near-term resistance is around 0.8450, a breach above targets 0.84650/0.84864. Any close above 0.84865 confirms minor bullishness, a jump to 0.8540 is possible. The immediate support is at 0.8420, any violation below will drag the pair to 0.83830 (Jul 17th, 2024). Any close below 0.83830 confirms the resumption of a major downtrend, a dip to 0.8330/$0.82550 is possible.

Indicator (hourly chart)

CCI (14)- Bullish

CCI (50)- Bullish

Average directional movement Index - Neutral

It is good to buy on dips around 0.8440 with SL around 0.8400 for a TP of 0.8485.