EURGBP hits multi-week low on board-based Euro weakness. Intraday bias remains bearish as long as 0.8400 holds. It hit a low of 0.8350 at the time of writing and is currently trading around 0.83570.

UK retail sales-

German flash manufacturing and services PMI in Sep came at 40.30 and 50.6, below a forecast of 42.40 and 51.10.

UK flash Manufacturing PMI declined to 51.50 in September from the previous month 52.50, below forecast of 52.50. While Services PMI dropped from 53.70 to 52.5 in Sep, compared to a forecast of 53.50.

The composite PMI in Sep came in at 52.90 vs 53.5 (expected) and the previous month's 53.80.

Technicals-

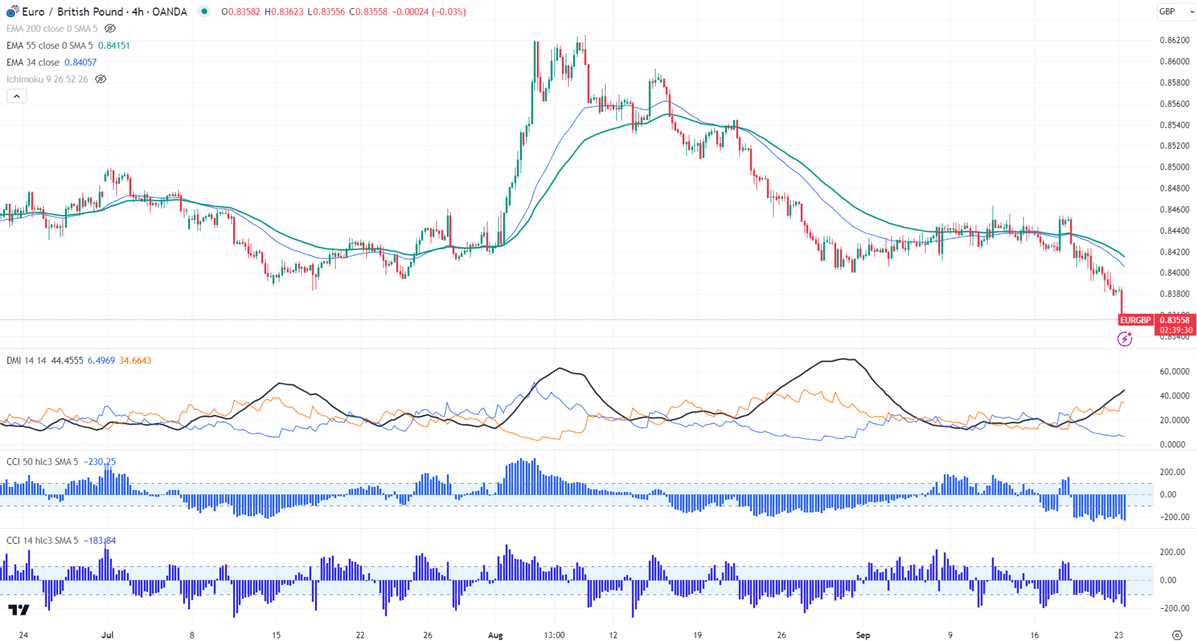

The pair is trading below 34- and above 55 EMA in the 4-hour chart.

The near-term resistance is around 0.8380, a breach above targets 0.8400/0.8420/8450/0.84650/0.84864 (38.2% fib of 0.8624 to 0.8399). Any close above 0.84865 confirms minor bullishness, a jump to 0.8540 is possible. The immediate support is at 0.8340, any violation below will drag the pair to 0.8300/0.8278.

Indicator (4- hour chart)

CCI (14)- Bearish

CCI (50)- Bearish

Average directional movement Index - Bearish

It is good to sell on rallies around 0.8378-80 with SL around 0.8420 for a TP of 0.8300.