EUR/JPY lost its shine on the weak Euro.It hit a low of 163.23 at the time of writing and is now trading around 163.51. The intraday outlook is bearish as long as the resistance 164.80 holds.

The euro is struggling lately due to political uncertainty in Germany and worries about trade wars. Germany's political situation has become unstable after Chancellor Olaf Scholz dismissed Finance Minister Christian Lindner, leading to the collapse of his coalition government. Scholz now leads a minority government, making it harder to pass important laws, and he has called for a confidence vote in January. If he fails, early elections could happen by March. Meanwhile, concerns about potential trade wars with the U.S. have also emerged, especially with Donald Trump back in power, raising fears of new tariffs on European goods. Analysts warn that these tariffs could lead to a 1.5% decline in Germany's GDP, putting additional pressure on its economy.

Technical Analysis

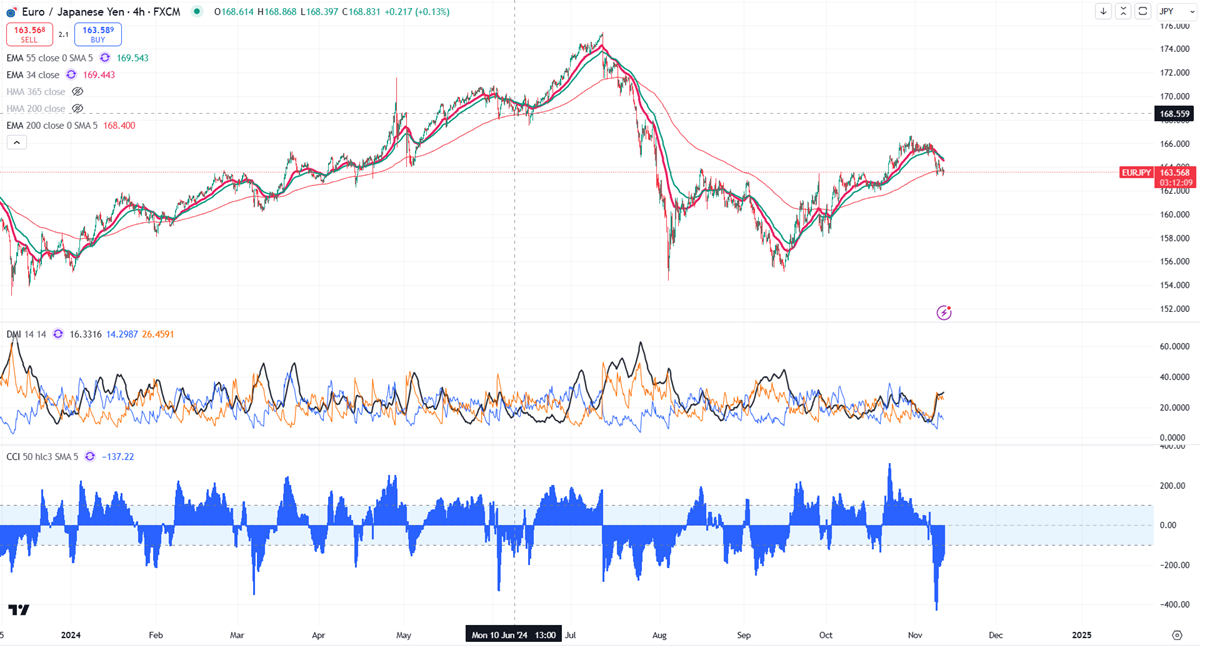

The pair is currently below the 34- and 55 EMA, as well as the 365 Hull moving average on the 4-hour chart.

Near-Term Resistance: Around 164. A breakout here could lead to targets of 164.25/164.80/165.35.

Immediate Support: At 163. If this level is breached, the pair could drop to 164/163, 162.17, 161.80, 161.20, 160.65, 160, 159, or 158.35.

Indicator Analysis (4-hour chart)

- CCI (50): Bearish

- Average Directional Movement Index: Bearish

Overall, indicators suggest a bearish trend.

Trading Recommendation

Consider selling on rallies around 163.78-80, with a stop loss at 164.80, aiming to take profit levels at 160.10.