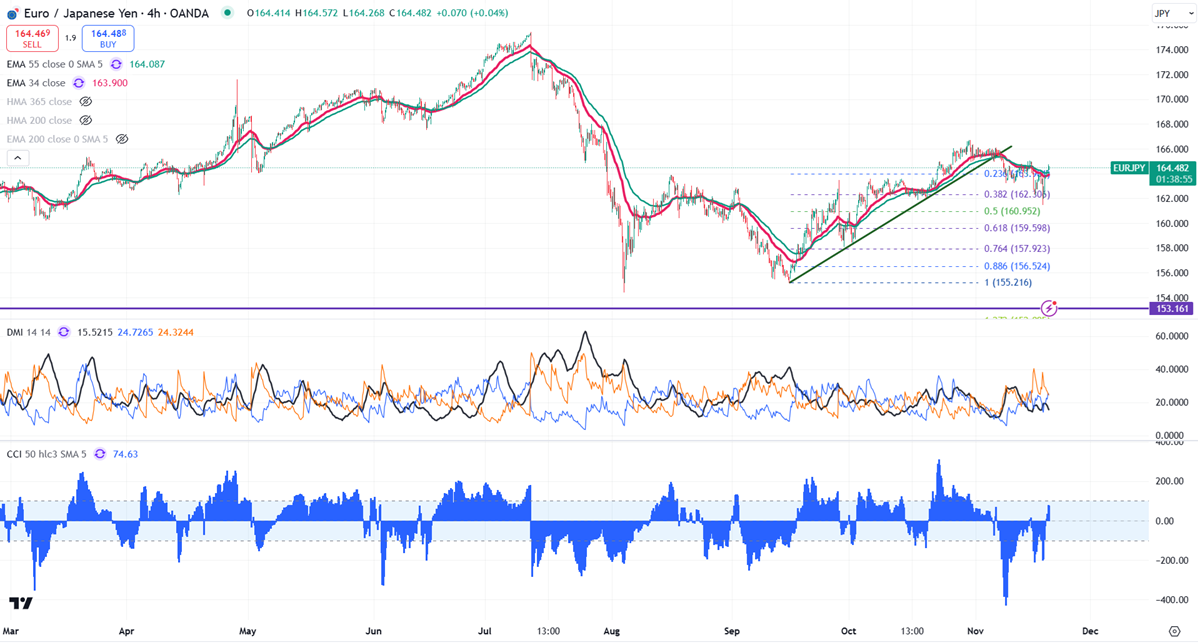

EUR/JPY showed a minor pullback on the weak yen. It hit a low of 161.47 yesterday and is now trading around 164.34. The intraday outlook is bullish as long as the resistance 163 holds.

The Producer Price Index (PPI) data for Germany in October 2024 has been released, showing a monthly increase of 0.2%, which matches what experts expected. Here are the main points:

- Monthly Change: Prices went up by 0.2%, just as predicted.

- Year-over-Year Change: Compared to October last year, producer prices fell by 1.4%, indicating ongoing deflationary pressures in the economy.

Technical Analysis

The pair is currently above the 34- and 55 EMA, as well as the 365 Hull moving average on the 4-hour chart.

Near-Term Resistance: Around 165. A breakout here could lead to targets of 165.35/166/166.69.

Immediate Support: At 163.75. If this level is breached, the pair could drop to 163/161.80/161.20, 160.65, 160, 159, or 158.35.

Indicator Analysis (4-hour chart)

- CCI (50): Bearish

- Average Directional Movement Index: Neutral

Overall, indicators suggest a bullish trend.

Trading Recommendation

Consider buying on dips around 164, with a stop loss at 162.75, aiming to take profit levels at 166