The EUR/JPY gained slightly after upbeat German PMI data. It hit an intraday high of 162.56 and is currently trading around 162.19. The intraday outlook is bullish as long as the support of 160.70 holds.

In March 2025, German Flash PMI was subdued with the Manufacturing PMI to a 31-month high of 48.3 as it relieved contraction slightly and the Services PMI to a four-month low of 50.2 as it reported slower growth. Even so, the HCOB Composite Output Index increased to 50.9, which forecasted overall economic expansion in the first quarter of 2025 as an indicator of the tough economic environment with market sentiment and outlook implications.

Technical Analysis:

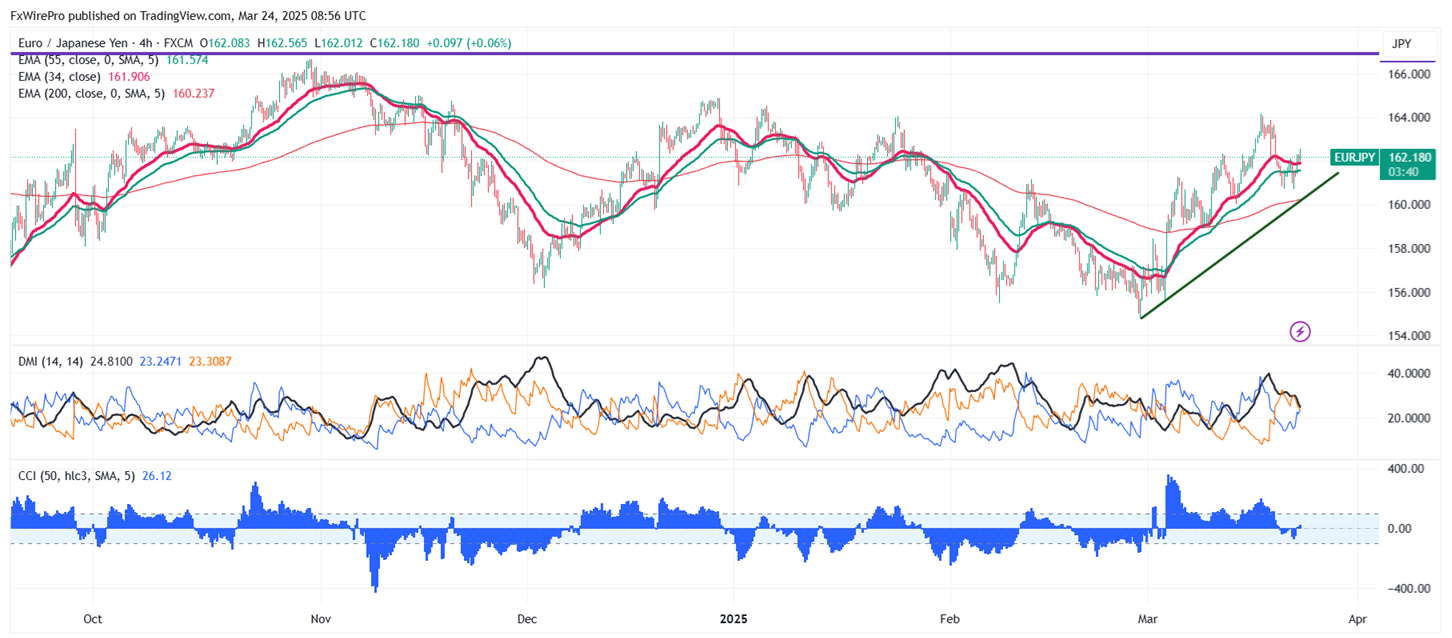

The EUR/JPY pair is trading above the 34,55 EMA and 200-4H EMA in the 4-hour chart.

- Near-Term Resistance: Around 162.60 a breakout here could lead to targets at 163/164.20/165/166.65/167.

- Immediate Support: At 161.50– if breached, the pair could fall to 160.40/ 162.30/161.80/160.75/59.70/159.25/158.85.

Indicator Analysis 4-hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Bullish

Overall, the indicators suggest bullish trend

Trading Recommendation:

It is good to sell on rallies around 162.50-55 with stop loss at 163.20 for a TP of 160.60.