The EUR/JPY pared most of its gains as the yen recovered. It hit an intraday low of 159.72 and is currently trading around 159.92. The intraday outlook is bearish as long as the resistance 162 holds.

The changes in U.S. trade policies, especially through tariffs that will affect European goods and may trigger trade wars, are likely to weaken the euro. His policy of reducing support for Ukraine worries European security and may make it difficult for nations to deal with Russia, harming investor confidence in the eurozone. Further, his vague support for NATO could force European countries to spend more on their defense, straining their budgets and affecting economic growth. The economic pressures could further cause the euro to lose value. In any case, the overall impact of these changes is still largely uncertain.

Technical Analysis:

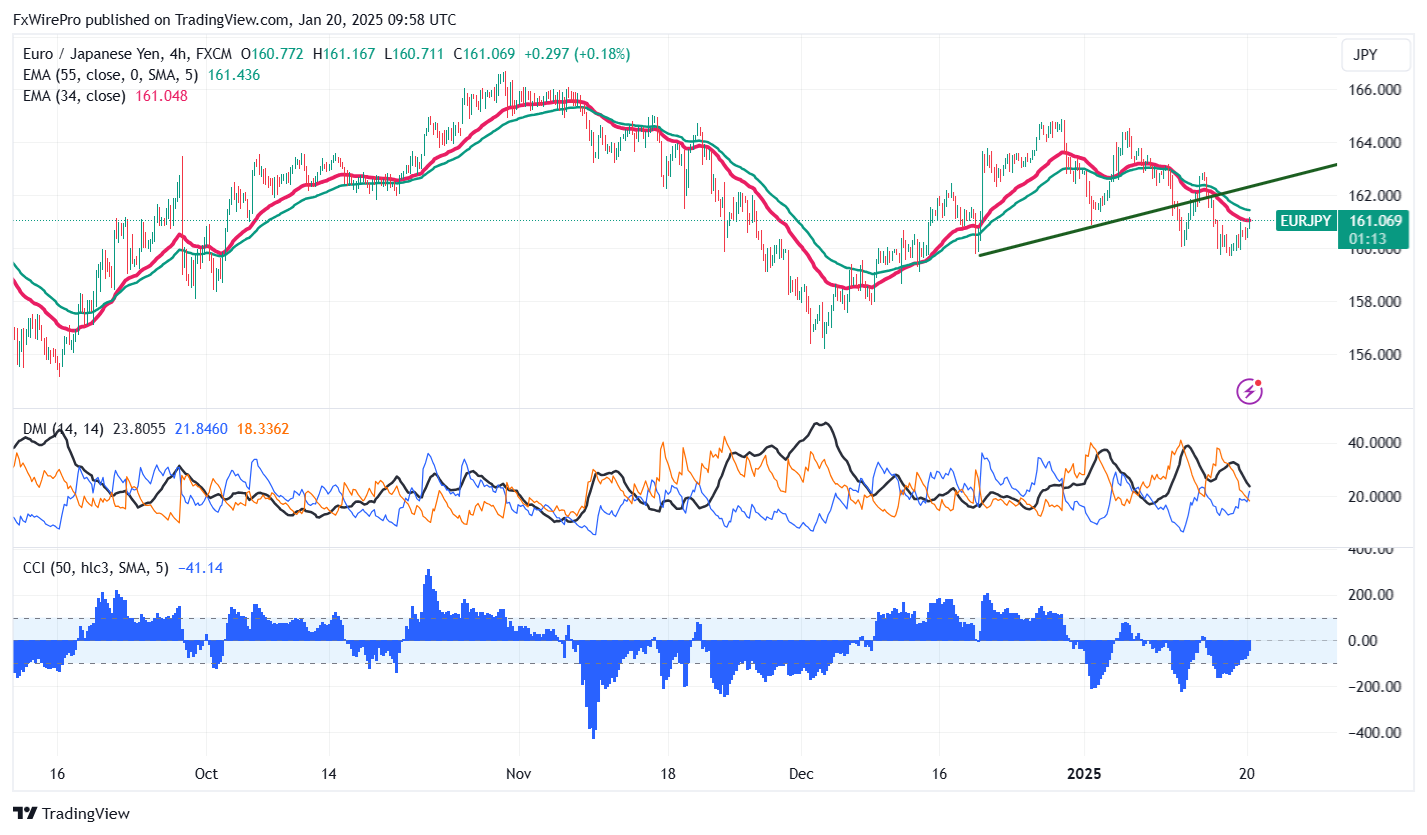

The EUR/JPY pair is trading below the 34,55 EMA and 200-4H EMA in the 4-hour chart.

- Near-Term Resistance: Around 161.20 a breakout here could lead to targets at 161.50/162/163/164/165/166.65/167.

- Immediate Support: At 159.70– if breached, the pair could fall to 158.80/157.76.

Indicator Analysis (4-hour chart): - CCI (50): Bearish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a mixed trend.

Trading Recommendation:

It is good to sell on rallies around 161.20-25 with a stop loss at 162 for a TP of 157.75.