FxWirePro- EURUSD Daily Outlook

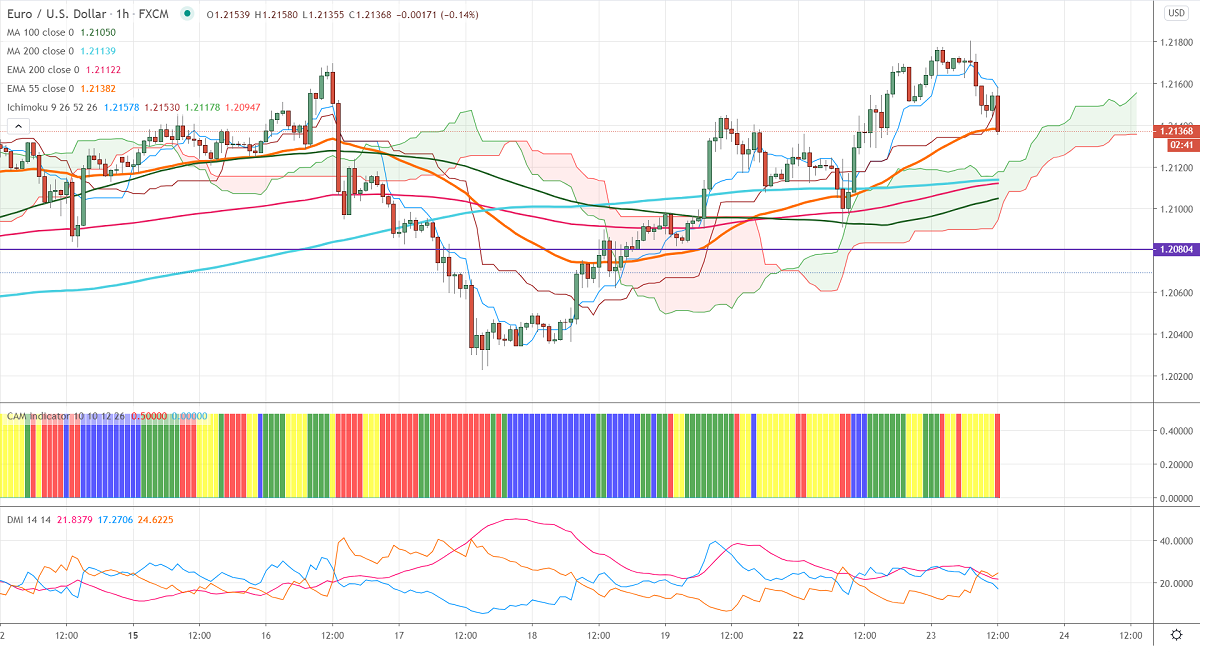

Ichimoku analysis (60 min chart)

Tenken-Sen- 1.21204

Kijun-Sen- 1.20790

EURUSD has lost more than 40 pips after hitting a high of 1.21801. The surging US bond yield is putting pressure on this pair at higher levels. Markets eye US Fed Powell testimony today for further direction. The Eurozone CPI came at 0.9% YoY in Jan slightly better than the previous month -0.3%. The dollar was one of the worst performers this week as the economic recovery has decreased demand for safe-haven assets. DXY has shown a minor recovery from a low of 89.94. Minor bullishness only above 90.60. EURUSD hits an Intraday low of 1.21438 and is currently trading around 1.21533.

Technical:

The pair is facing strong support at 1.21045. Any break below confirms minor bearishness, a dip till 1.2080/1.2020 likely. The near-term resistance is around 1.2180. Breach above will take the pair to next level 1.2200/1.2260.

Indicator (60 min chart)

CAM indicator – neutral

Directional movement index – neutral

It is good to buy on dips around 1.2090 with SL around 1.2060 for the TP of 1.2200.