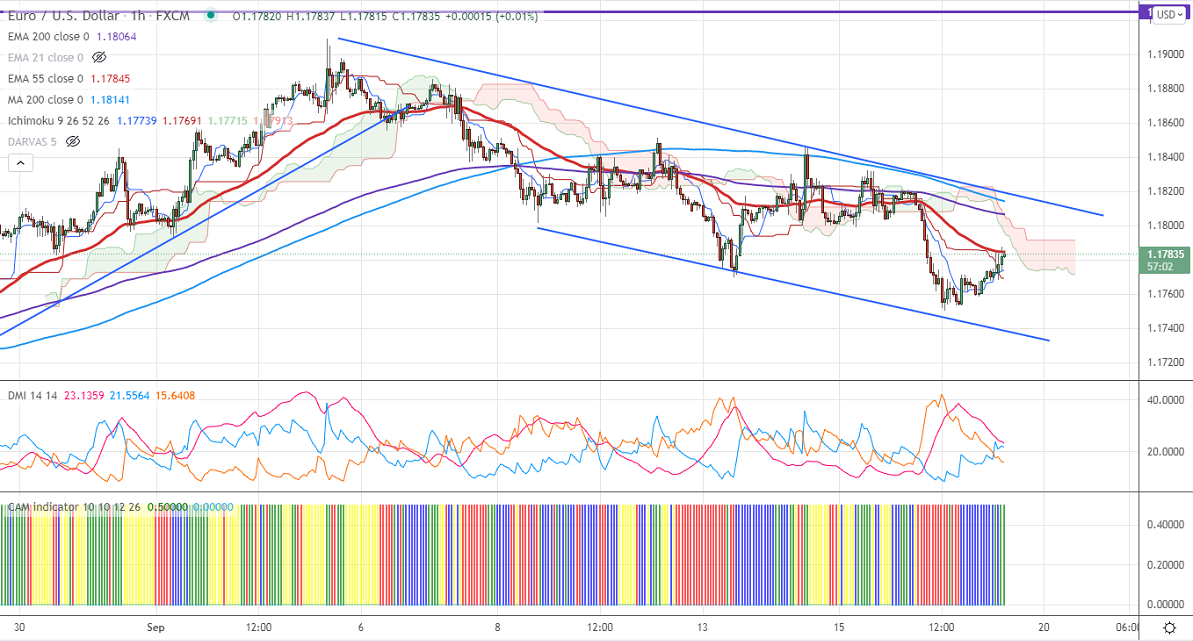

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.17718

Kijun-Sen- 1.17691

EURUSD halted its two-day losing streak and shown a minor pullback. The pair has fallen drastically yesterday after upbeat US retail sales data. The US headline retail sales rose by 0.7% in Aug compared to an estimate of -0.7%. The number of people who have filed for unemployment benefits jumped by 20000 to 332000 for the week ended September. The pair hits an intraday high of 1.17850 and is currently trading around 1.17781.

Technical:

On the higher side, near-term resistance is around 1.18180 and any convincing breach above will drag the pair to the next level 1.1850/1.18850/1.1920. The pair's immediate support is at 1.1750, break above targets 1.1700/1.1660.

Indicator (4-hour chart)

CAM indicator-Slightly Bullish

Directional movement index – Neutral

It is good to sell on rallies around 1.1838-40 with SL around 1.18850 for the TP of 1.1700.