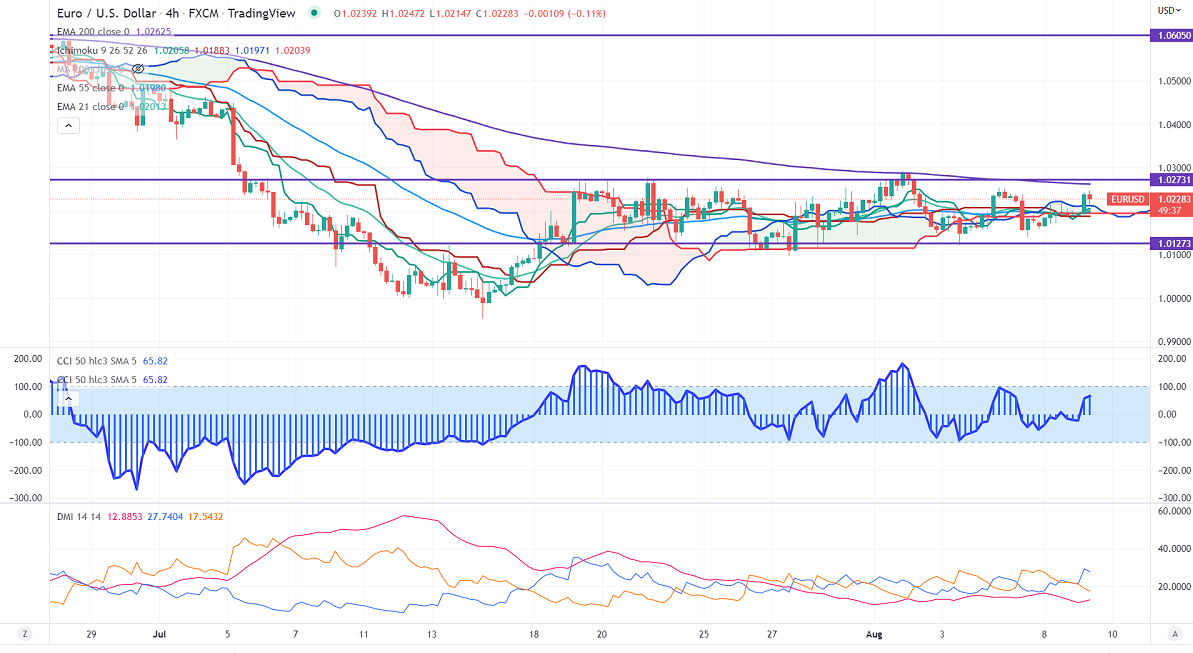

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.02019

Kijun-Sen- 1.01883

EURUSD pared some of its gains despite upbeat market sentiment. Market eyes German and US CPI data tomorrow for further direction. According to Institute for Employment Research (IAB), Germany's economy is expected to lose more than USD 265 billion due to higher energy prices in the Ukraine war. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 67.50% from 41% a week ago.

EURUSD hits an intraday high of 1.02446 and is currently trading around 1.02293.

Technical:

On the higher side, near-term resistance is around 1.0300 and any convincing breach above will drag the pair to the next level of 1.0350/1.0500/1.075.

The pair's immediate support is at 1.010, breaking below targets of 1/0.9940.

Indicator (hourly chart)

Directional movement index – Neutral

It is good to buy on dips around 1.0200 with SL around 1 for a TP of 1.075.