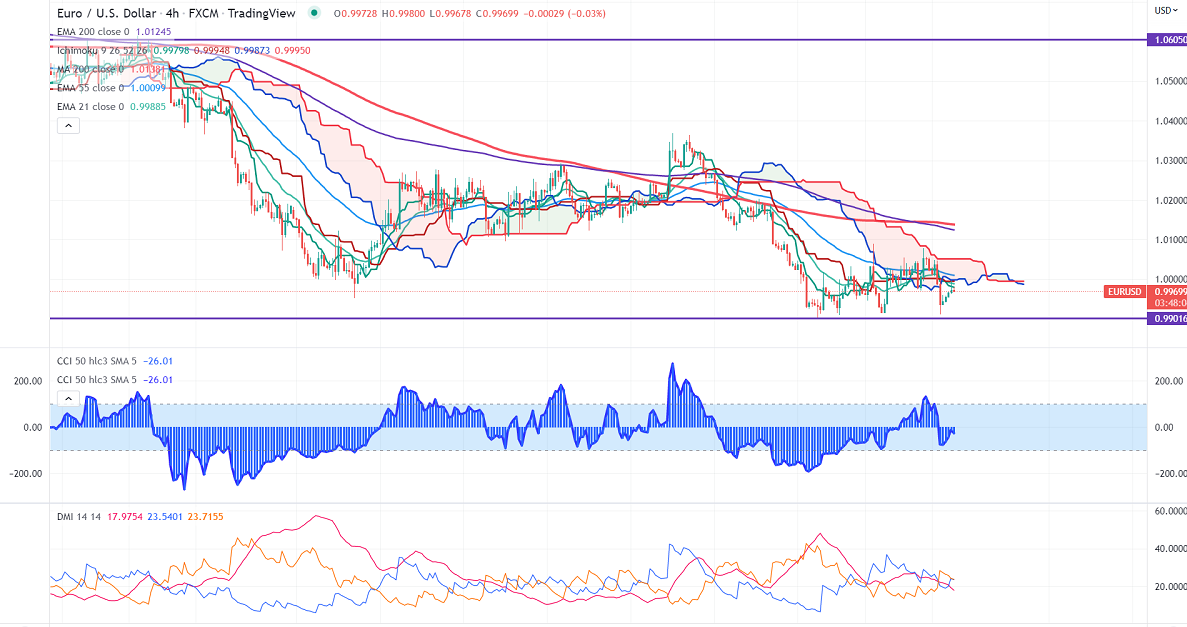

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.99825

Kijun-Sen- 0.99948

EURUSD recovered slightly ahead of US Non-Farm Payroll. The US economy is expected to add 30000 jobs below 528000 in July. Any dismal data will push the Euro higher. Hawkish rate hike bets from European Central Bank prevent the pair from further sell-off.

US ISM manufacturing PMI came at 52.80 in Aug vs expectations of 52. The number of people who have filed for unemployment benefits has dropped to 23200 compared to an estimated 252K.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 74% from 64% a week ago.

US 10-year yield is consolidating after a jump of more than 31%. The spread between German and Italian yields was close to 2.35%.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 73% from 64% a week ago.

EURUSD hits a high of 0.99962 and is currently trading around 0.99712.

Technical:

On the higher side, near-term resistance is around 1.0400 and any convincing breach above will drag the pair to the next level of 1.075/1.0100.

The pair's immediate support is at 0.9970, breaking below targets of 0.9940/0.9890.

Indicator (4-hour chart)

Directional movement index – Bullish

It is good to buy above 1.0100 with SL around 0.9960 for a TP of 1.0650. or

Sell below 0.9910 with SL around 0.9965 for TP of 0.9800.