EURUSD surged nearly 150 pips on board-based US dollar selling. US consumer prices jumped 7.1% YoY, slightly below the estimate of 7.3%. Core CPI month-on-month basis came at 0.10% vs forecast of 0.30%. The chance of an aggressive rate hike declined after a drop in inflation. It hits an intraday high of 1.06735 and is currently trading around 1.06413.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec rose to 79.40% from 78.20% a week ago.

The US 10-year yield lost more than 5% from this week's high of 3.61%. The US 10 and 2-year spread narrowed to 71 basis points from -85 bpbs.

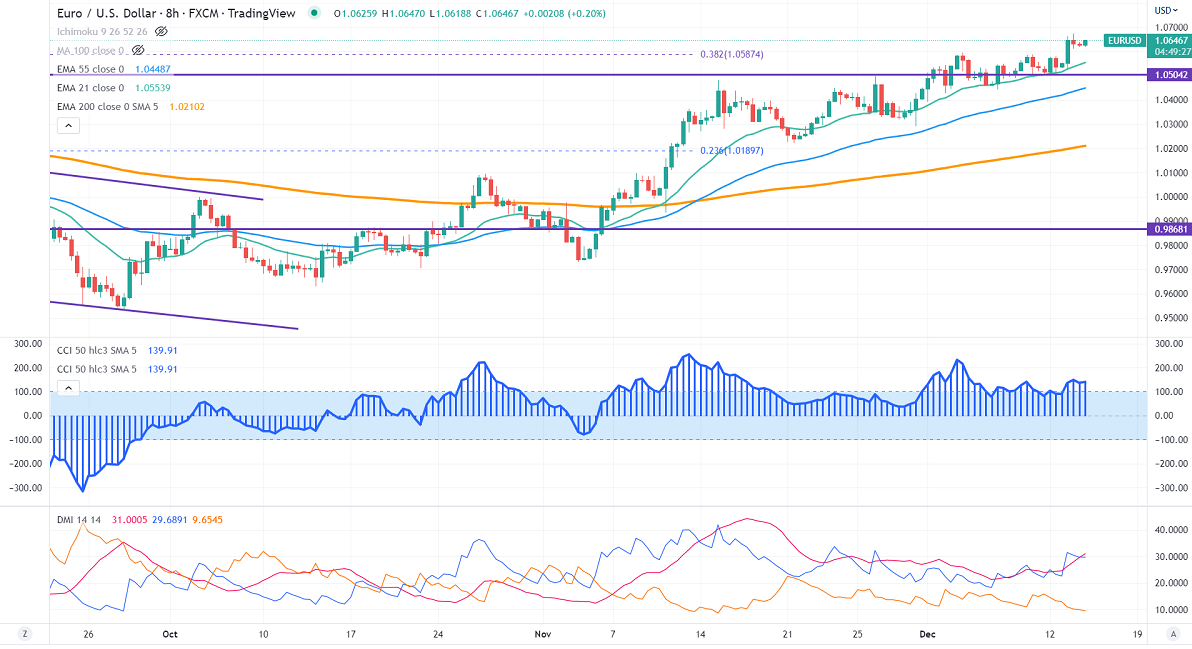

Technical:

On the higher side, near-term resistance is around 1.0660 and any convincing breach above will take the pair to the next level of 1.0750/1.0800.

The pair's immediate support is at 1.0570, breaking below targets of 1.0500/1.0430/1.0370/1.02900.

Indicator (4-hour chart)

Directional movement index – Bullish

CCI(50)- Bullish

It is good to buy on dips around 1.0600 with SL around 1.0560 for a TP of 1.0750.

FxWirePro- EURUSD Daily Outlook

Wednesday, December 14, 2022 9:14 AM UTC

Editor's Picks

- Market Data

Most Popular