EURUSD trades flat after a nice pullback above 1.07500. Markets await the US Fed chairman's speech for further movement. The pair was one of the best performers in the past two days due to weak US jobs data. The sell-off in US treasury yield also puts pressure on the US dollar at higher levels. It hits an intraday high of 1.07475 and is currently trading around 1.07407.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb rose to 78.7% from 67.7% a week ago.

The US 10-year yield declined below the 3.60% level once again. Any break and close below 3.32% confirm the further bearish trend. The yield spread between 10 and 2-year narrowed to -67.9 basis points from -77 bpbs.

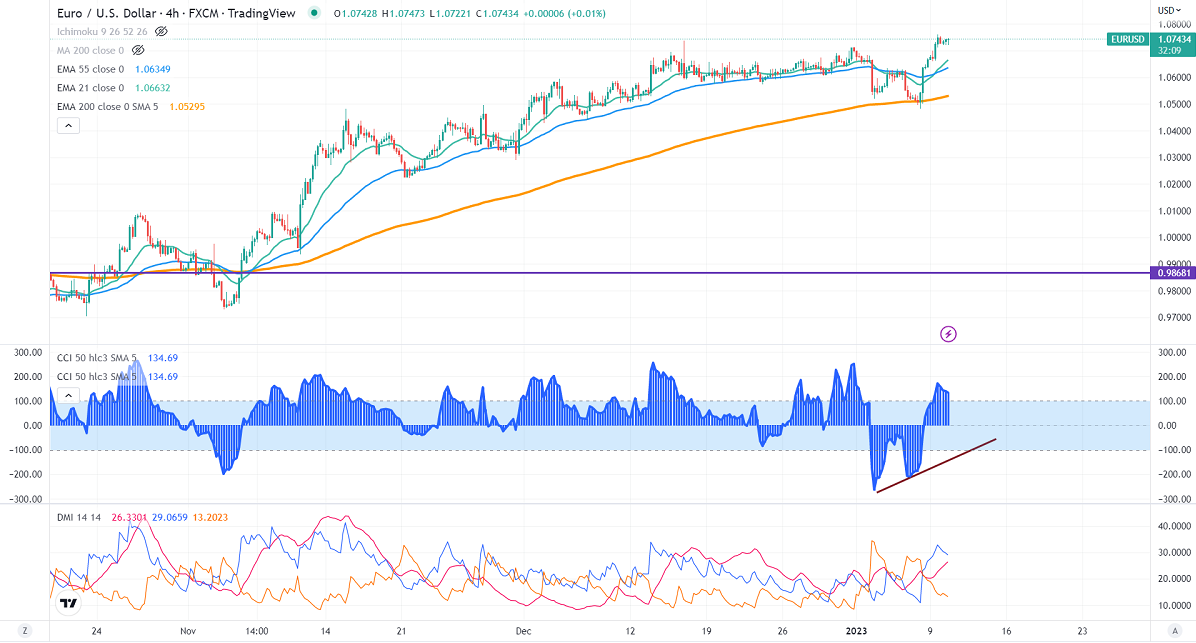

Technical:

On the higher side, near-term resistance is around 1.0760 and any convincing breach above will take the pair to the next level of 1.0800/1.0855.

The pair's immediate support is at 1.0690, breaking below targets of 1.0660/1.0600/1.0570/1.0500.

Indicator (4-hour chart)

Directional movement index – Bullish

CCI(50)- Bullish

It is good to buy on dips around 1.0680-825 with SL around 1.0630 for a TP of 1.0800.