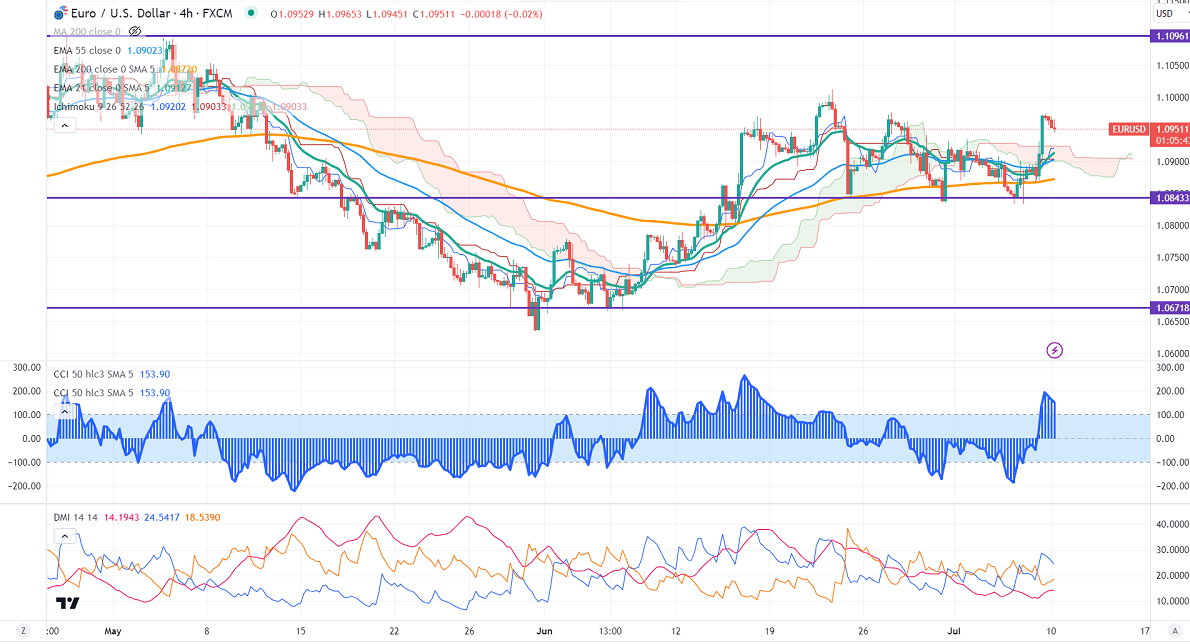

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.09202

Kijun-Sen- 1.09033

EURUSD consolidating after a nice pullback above 1.09500. The pair gained momentum after weak US jobs data. It hits a high of 1.09717 and is currently trading around 1.09539.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 92.40% from 86.80% a week ago.

The US 10-year yield hits the highest level since 2007 despite weak US jobs data. The US 10 and 2-year spread narrowed to -86.80% from -110%.

The pair trades above short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any indicative break above 1.0965 confirms intraday bullishness; a jump to 1.1000/1.1100 is possible. The near-term support is around 1.0900. The breach below targets 1.0865/1.0830/1.0800.

Indicator (4-hour chart)

CCI – Bullish

Directional movement index – Neutral

It is good to sell on rallies around 1.0950 with SL around 1.100 for a TP of 1.0800.