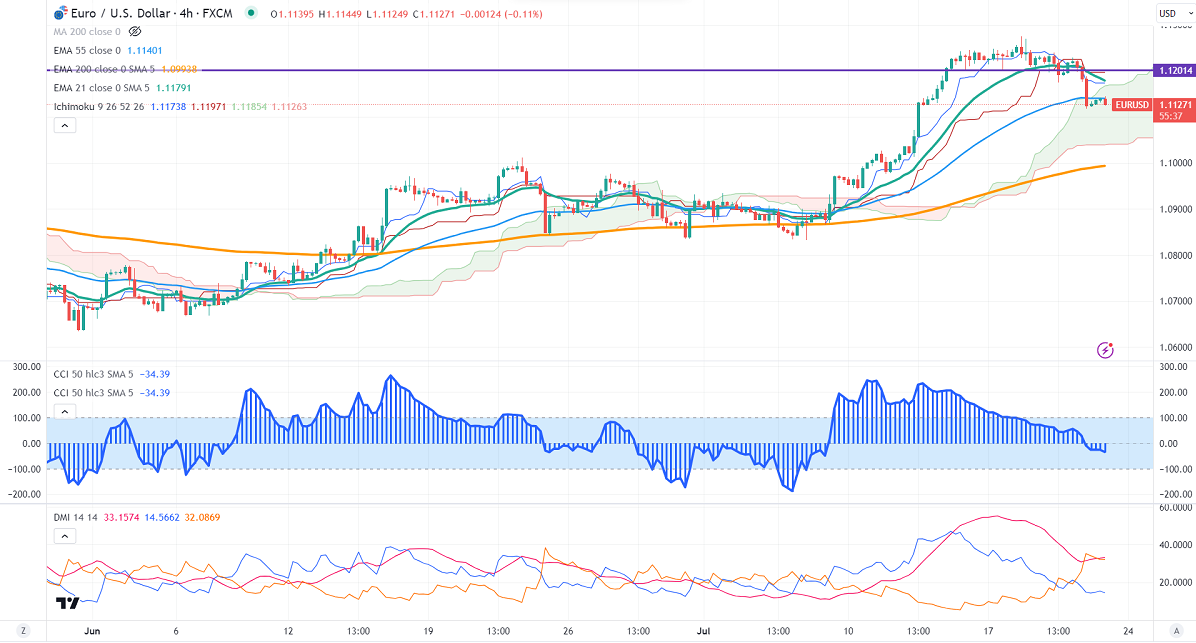

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.11738

Kijun-Sen- 1.11971

EURUSD lost its shine after mixed US economic data. The number of people who have filed for unemployment benefits declined to 228000 in the week ending July 15th, compared to a forecast of 242K. US Philly fed manufacturing index dropped to -13.50 vs.-10 expected. It hits an intraday low of 1.1118 and is currently trading around 1.11313.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 99.80% from 93% a week ago.

The US 10-year yield showed a minor pullback on mixed US economic data. The US 10 and 2-year spread narrowed to -98.6% from -110%.

The pair trades below short-term 21 EMA, 55 EMA, and above long-term (200-EMA) in the 4-hour chart. Any indicative break below 1.1100 confirms intraday bearishness; a decline to 1.1000/1.0950 is possible. The near-term resistance is around 1.1150. The breach above targets 1.1200/1.1275.

Indicator (4-hour chart)

CCI – Bearish

Directional movement index – Neutral

It is good to sell on rallies around 1.1148-50 with SL around 1.1200 for a TP of 1.1000.