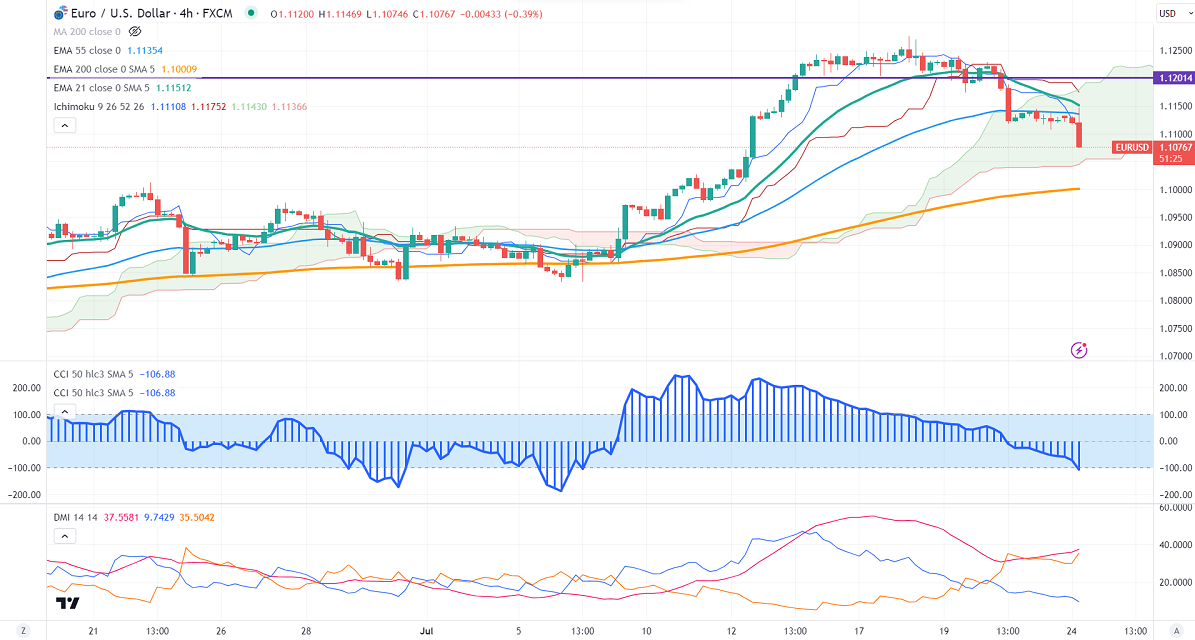

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.11264

Kijun-Sen- 1.11917

EURUSD lost its shine after dismal German PMI data. It came at 38.80 in Jul, compared to a forecast of 41. French flash manufacturing PMI dropped to 44.50 vs. the Estimate of 46.10. It hits an intraday low of 1.10746 and is currently trading around 1.10788.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 99.80% from 93% a week ago.

The US 10-year yield showed a minor pullback ahead of US Fed monetary policy. The US 10 and 2-year spread narrowed to -98.6% from -110%.

The pair trades below short-term 21 EMA, 55 EMA, and above long-term (200-EMA) in the 4-hour chart. Any indicative break below 1.1050 confirms intraday bearishness; a decline to 1.1000/1.0950 is possible. The near-term resistance is around 1.1150. The breach above targets 1.1200/1.1275.

Indicator (4-hour chart)

CCI – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1100 with SL around 1.1150 for a TP of 1.1000.