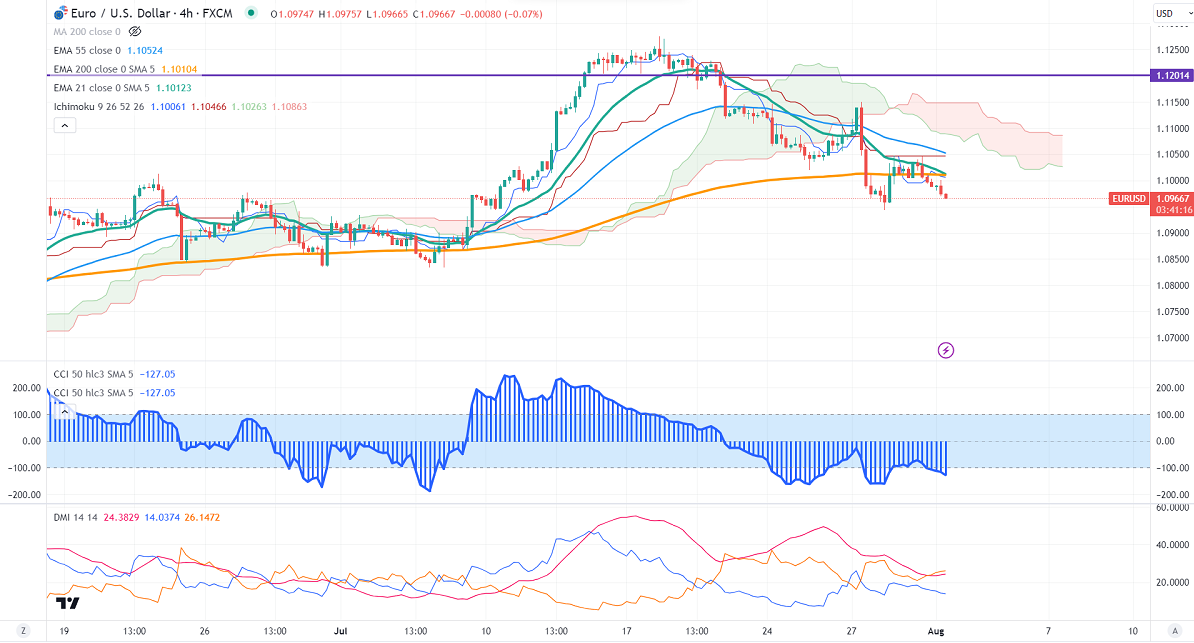

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.10080

Kijun-Sen- 1.10466

EURUSD showed a minor sell-off despite a positive Euro PMI. Eurozone final PMI came at 4.27 in Jul, in line with the estimate. German Final manufacturing PMI dropped to 38.8 in Jul from the previous month's 40.60. It hits a low of 1.09683 and is currently trading around 1.09682.

According to the commerce department, the PCE index increased 0.20%, in line with the estimate. Core inflation rose 4.1% YoY, down from 4.6% in May. Markets eye Euro CPI flash estimate data for further direction.

Major economic data for the day

Aug 1st, 2023, US ISM manufacturing PMI (2:00 pm GMT)

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 82.50% from 81.60% a week ago.

The US 10-year yield trades flat ahead of the US ISM manufacturing PMI. The US 10 and 2-year spread narrowed to -90.30 from -110%.

The pair trades below short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any indicative break above 1.1050 confirms further bullishness: a jump to 1.1100/1.1150 is possible. The near-term support is around 1.0950. The breach below targets 1.0900/1.0830.

Indicator (4-hour chart)

CCI – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.0985-875 with SL around 1.1050 for a TP of 10800.