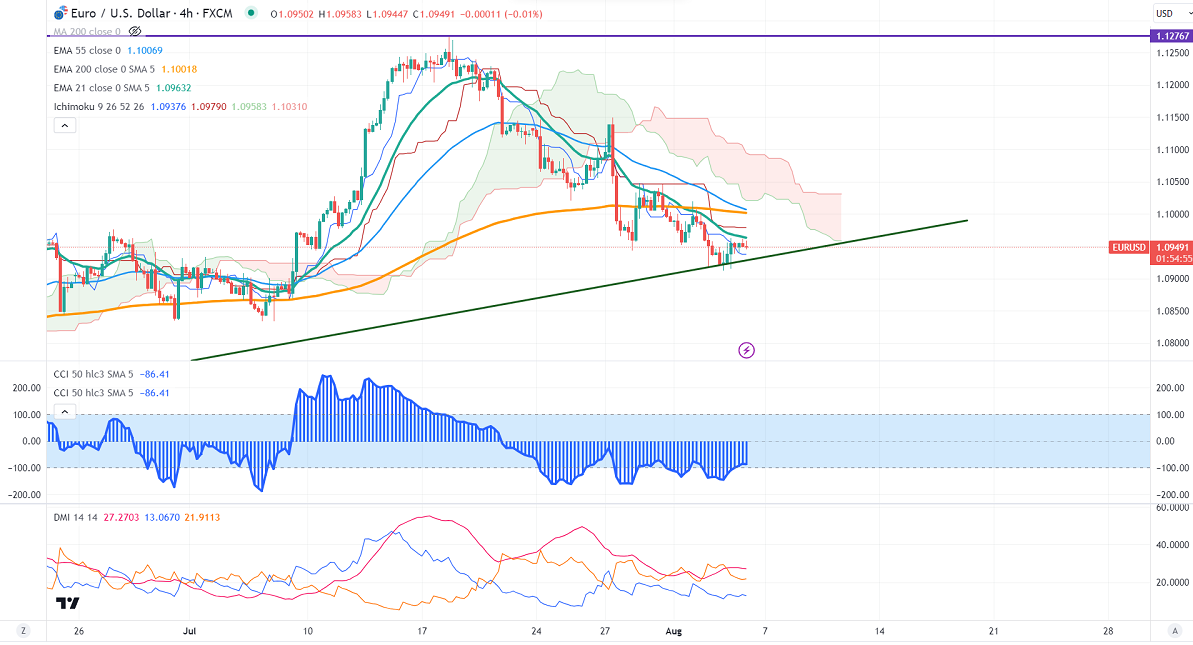

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.09376

Kijun-Sen- 1.09790

EURUSD showed a minor pullback ahead of the US Non-farm payroll. The pair gained momentum on mixed US economic data. It hits a high of 1.09616 and is currently trading around 1.09487.

The number of people who have filed for unemployment benefits rose by 6000 to 227000 in the week ending July 29, in line with an estimate 226000. US ISM services PMI dropped to 52.70 in Jul, compared to a forecast of 53.

Major economic data for the day

Aug 4th, 2023, Non-farm employment change (12:30 pm GMT)

Unemployment rate(12:30 pm GMT)

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 82.50% from 78% a week ago.

The US 10-year yield gained sharply ahead of US NFP data. The US 10 and 2-year spread narrowed to -73.10 from -110%.

The pair trades below short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any indicative break below 1.0900 confirms further bearishness: a decline to 1.0850/1.0800 is possible. The near-term resistance is around 1.0960. The breach above targets 1.100/1.1050.

Indicator (4-hour chart)

CCI – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.0950 with SL around 1.1000 for a TP of 10800.