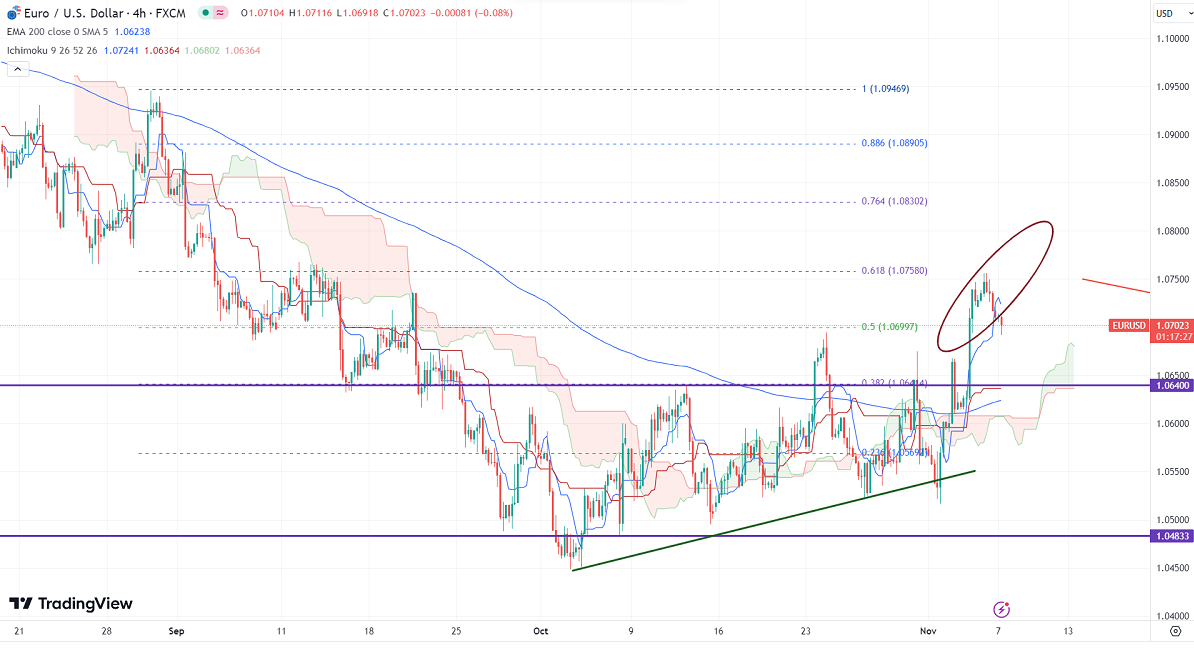

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.07308

Kijun-Sen- 1.06364

Candlestick - Shooting Star (Daily chart)

EURUSD halted its two-day winning streak and showed a minor sell-off. It hit a high of 07562 yesterday and is currently trading around 1.06991.

The pair surged sharply on Friday after weak US Nonfarm payroll data. The weak US jobs data confirms that the central bank will continue the rate pause for some more time. Markets eye the US fed and ECB member's speech for further movement.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 90.2% from 74.40% a week ago.

The US 10-year yield showed a minor pullback of more than 4% from a minor bottom of 4.48%. The US 10 and 2-year spread widened to -28% from -22%.

The pair trades above short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any break above 1.0760 confirms further bullishness. A jump to 1.0800/1.0830/1.09450 is possible. The near-term support is around 1.0680 and any breach below targets is 1.06300/1.0550. Bullish invalidation only if it breaks below 1.0440.

Indicator (4-hour chart)

CCI – bullish

Directional movement index – Bullish

It is good to buy on dips around 1.0718-20 with SL around 1.0660 for a TP of 1.0900.