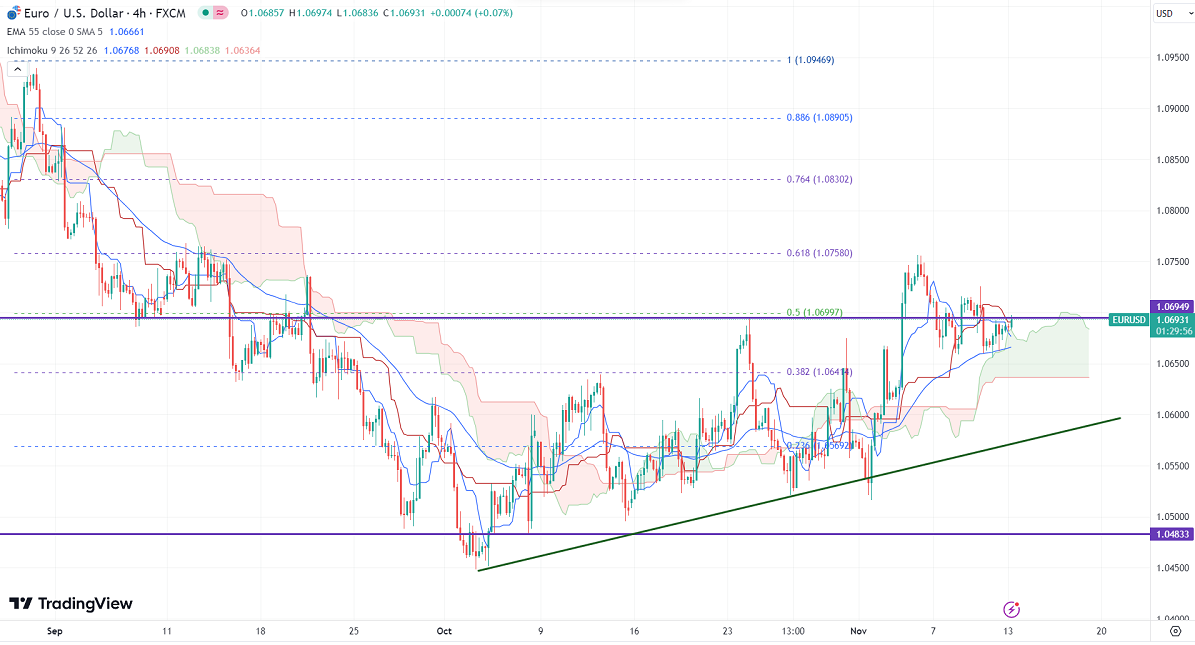

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.06809

Kijun-Sen- 1.06908

EURUSD has traded in a narrow range between 1.07563 and 1.06561 for the past week. It hit a high of 1.06974 at the time of writing and is currently trading around 1.06937.

The pair witnessed bearish pressure after hawkish comments from Fed Chairman Powell on Thursday.

Major Economic Data for the Week

Nov 14 th 2023, US Core CPI m/m (1:30 pm GMT)

Nov 15th, 2023. US Core PPI m/m (1:30 pm GMT)

Core retail sales m/m (1:30 pm GMT)

Empire State Manufacturing Index (1:30 pm GMT)

Nov 16th, 2023, US Initial jobless claims (1:30 pm GMT)

Philly Fed Manufacturing Index

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 86% from 95.2% a week ago.

The US 10-year yield showed a minor pullback of more than 4% after hitting a multi-week low. The US 10 and 2-year spread widened to -40% from -16%.

The pair trades above short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any break below 1.0660 confirms further bearishness. A decline to 1.0600/1.0550 is possible. The near-term resistance is around 1.0720 and any breach above targets is 1.0765/1.0835. Bullish invalidation only if it breaks below 1.0440.

Indicator (4-hour chart)

CCI – bullish

Directional movement index – neutral

It is good to sell on rallies around 1.0700-025 with SL around 1.0760 for a TP of 1.0440.