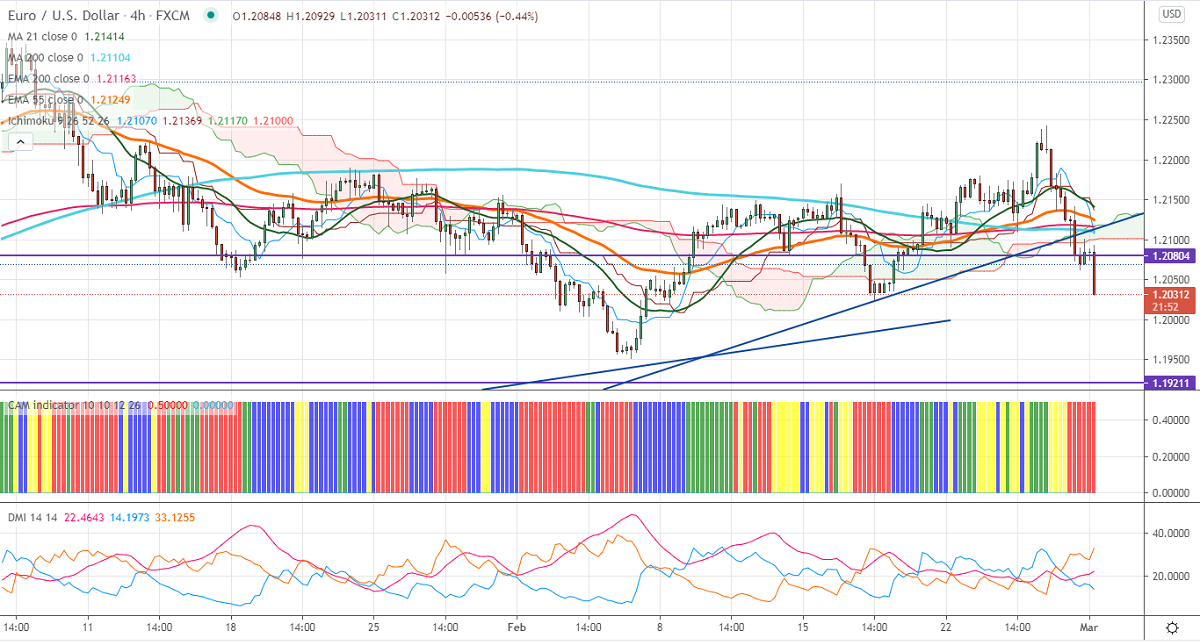

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.21380

Kijun-Sen- 1.21524

EURUSD continues to trade lower and lost more than 150 pips from minor top 1.2247 on broad-based US dollar buying. The jump in US 10- year yield on hopes of more fiscal stimulus is supporting the US dollar. DXY jumped above 91 levels and a jump to 91.60 likely. Markets eye US ISM manufacturing index and construction spending for further direction. EURUSD hits an Intraday low of 1.21290 and is currently trading around 1.21377.

Technical:

The pair is facing strong support at 1.2020. Any break below confirms minor bearishness, a dip till 1.2000/1.1945 likely. The near-term resistance is around 1.20655. Indicative Breach above will take the pair to next level till 1.2101/1.2160.

Indicator (4 Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 1.2038-40 with SL around 1.2078 for the TP of 1.1945.