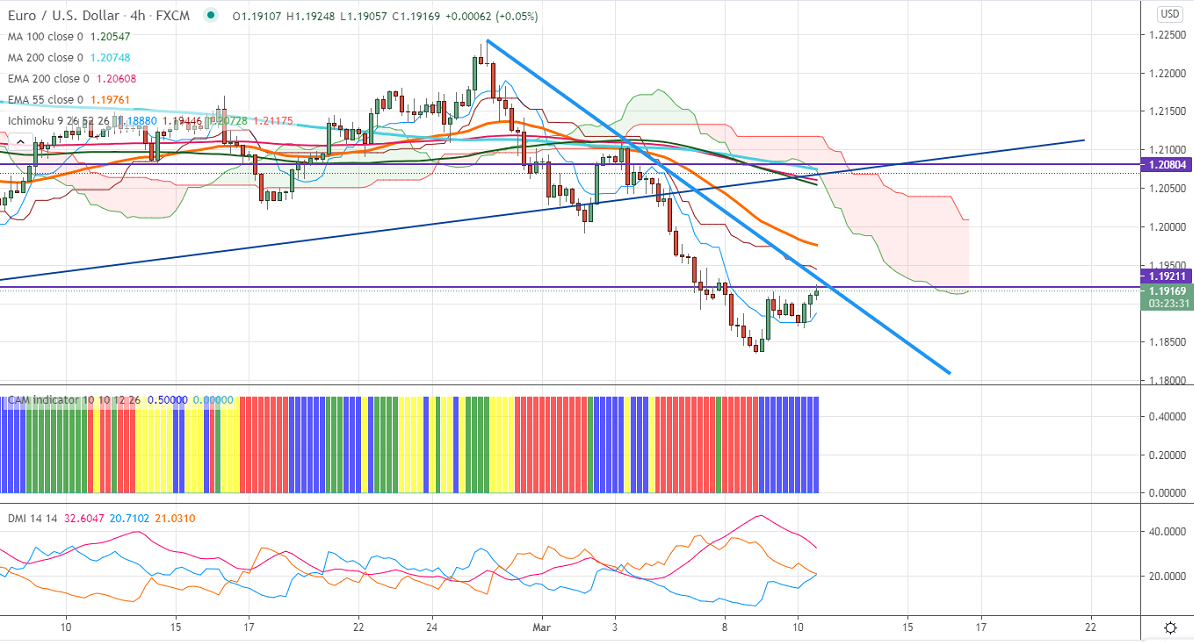

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.18756

Kijun-Sen- 1.19500

EURUSD recovered slightly after forming a minor bottom around 1.18355 on weak US inflation data. The US dollar is under pressure ahead of voting on stimulus. The inflation data came at 1.3% YoY compared to a forecast of 1.4%. While CPI ex-food and energy at 0.1% m/m vs 0.2% expected. US 10- year declined more than 1.5% after the data. Technically the pair is still under downtrend as long as trend line resistance 1.1945 holds. The US has once again resumed its upward journey after hitting a low of 1.52% is supporting the US dollar at lower levels. Markets eye House of Representatives votes on the senate's $1.9 trillion stimulus bill today for further direction. EURUSD hits an Intraday low of 1.19020 and is currently trading around 1.18987.

Technical:

The pair is facing strong at 1.1820. Any break below confirms minor bearishness, a dip till 1.1178/1.17480 likely. The near-term resistance is around 1.1950. An indicative breach above will take the pair to next level till 1.200/1.2035. Short-term trend reversal only above 1.2260.

Indicator (4 Hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1950-525 with SL around 1.2000 for the TP of 1.18300.