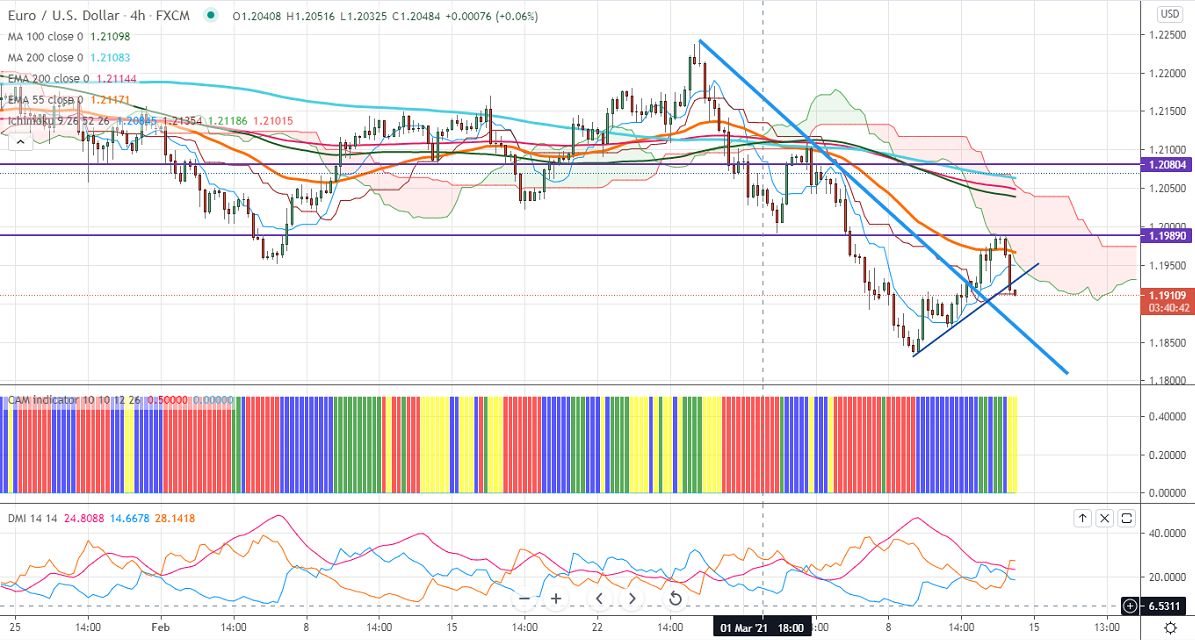

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.19505

Kijun-Sen- 1.19128

EURUSD declined after massive recovery till 1.19898. The minor sell-off came after a strong rebound in US bond yield. The pair surged after ECB that it is planning to increase the pace of bond buying to compete for a pandemic. But slow vaccination in Europe is putting on this pair at higher levels.

The number of people who have filed for unemployment benefits has fallen to 712000 in the week ended March 6th, compared to the forecast of 730k. . US president Biden signed a $1.9 trillion stimulus bill to boost economic recovery.

Technically the pair is still under a downtrend as long as resistance 1.2000 holds. US 10- year yield jumped more than 9% from a low of 1.475%. EURUSD hits an Intraday low of 1.19101 and is currently trading around 1.19116.

Technical:

The pair is facing strong at 1.1900. Any break below confirms minor bearishness, a dip till 1.1835/1.1800 likely. The near-term resistance is around 1.1200. An indicative breach above will take the pair to next level till 1.2035/1.20634 (200- 4H MA). Short-term trend reversal only above 1.2260.

Indicator (4 Hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1928-30 with SL around 1.1985 for the TP of 1.18300.