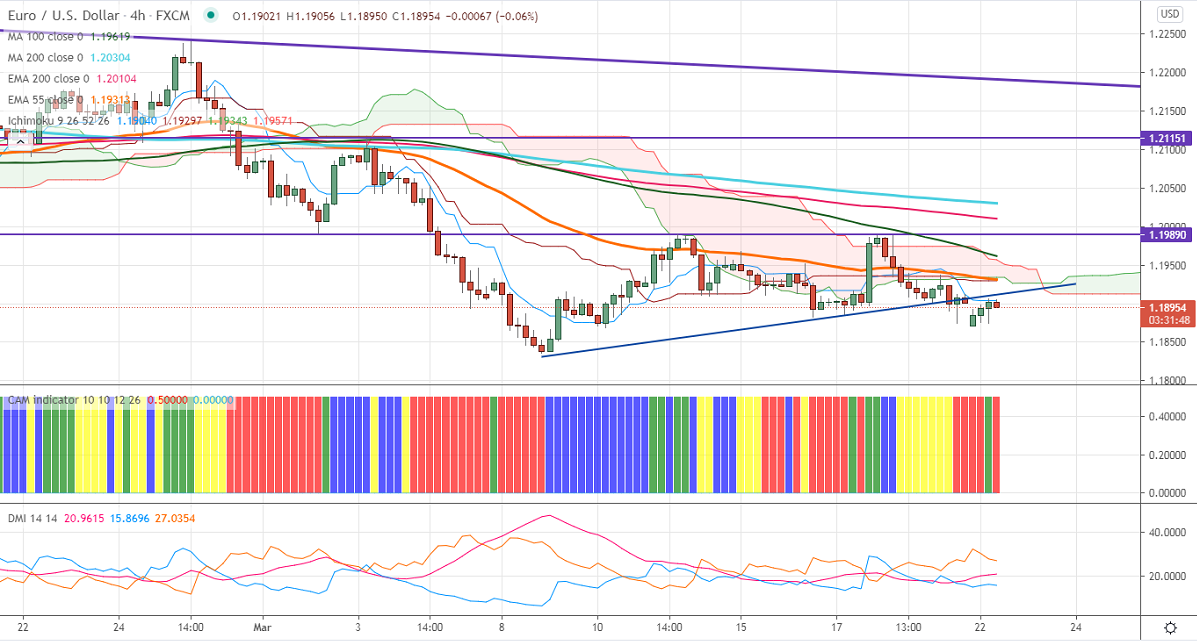

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.19040

Kijun-Sen- 1.19297

EURUSD has slightly recovered after hitting a low of 1.18708. The minor sell-off in the US -10-year bond yield is putting pressure on the US dollar. The rise in the number of new cases in Germany and extension of lockdown by 4 weeks and the slow vaccine rollout in Europe is dragging the Euro further down. Markets eye US Fed Chairman Powell speech today for further direction.

DXY is struggling to close above 92 levels. The intraday bullishness only if it breaks 92.20. EURUSD hits an intraday high of 1.19056 and is currently trading around 1.198988.

Technical:

The pair is facing strong support at 1.1835. Any break below confirms minor bearishness, a dip till 1.1800/1.1780/1.17335 likely. The near-term resistance is around 1.1930. An indicative breach above will take the pair to next level till 1.1965/1.2000/ 1.2030 (200- 4H MA)/1.20653. Short-term trend reversal only above 1.2260.

Indicator (4 Hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1928-30 with SL around 1.19850 for the TP of 1.1780.