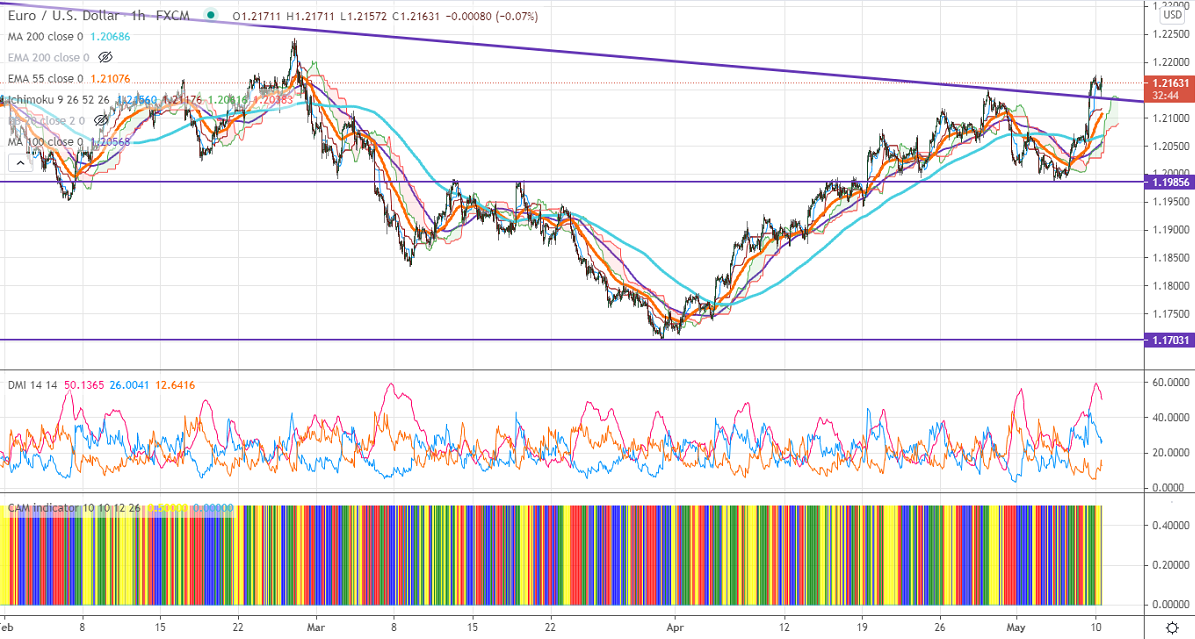

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.21560

Kijun-Sen- 1.21167

EURUSD is trading higher and hovering near the previous week on broad-based US dollar selling. The weak US Non-farm payroll is putting pressure on the US dollar. The US Non-Farm payroll raised by 266000 in Apr much below estimates of 990K and the unemployment rate increased to 6.1% from 6%. Average hourly earnings m/m surged to 0.7% vs estimate 0.0%. The better-than-expected Eurozone Sentix investor confidence and jump in the German bund is also supporting Euro. DXY breaks immediate support 90.40. Any breach below 90 confirms further weakness.

Technical:

On the higher side, near-term resistance is around 1.2180, and any breach below targets 1.2260/1.2300/1.2325. The pair's near-term support is around 1.2150. Any surge above 1.2150 confirms a bullish continuation. A jump till 1.22000/1.2260 is possible.

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index – Bullish

It is good to buy on dips around 1.2120 with SL around 1.2080 for the TP of 1.2260.