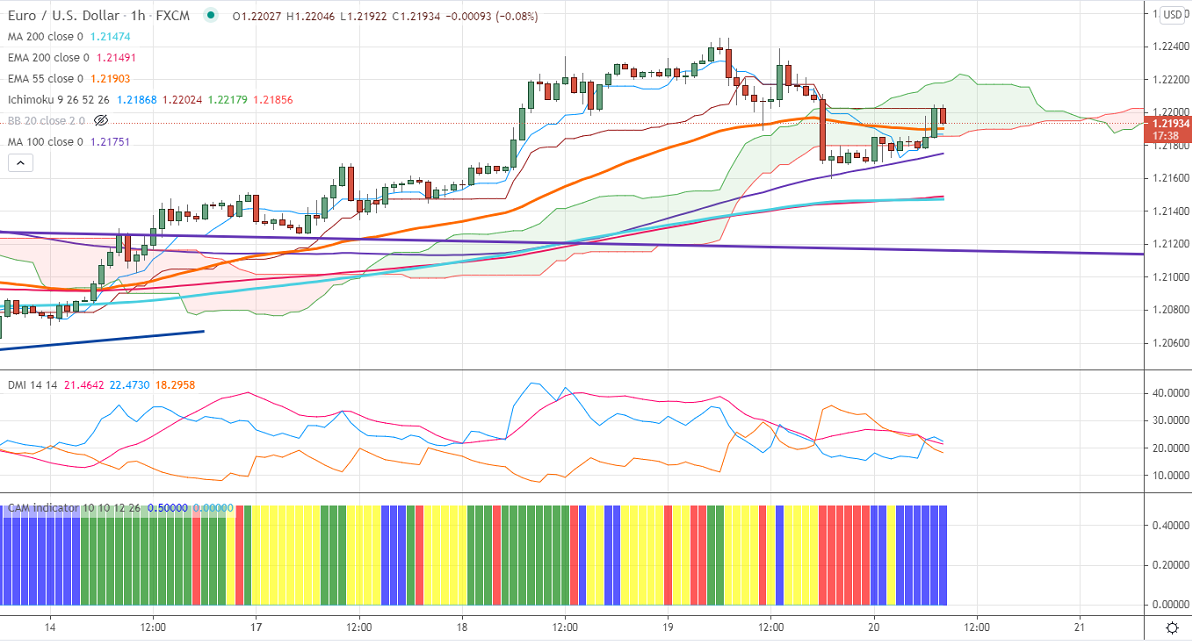

Ichimoku analysis (Hourly chart)

Tenken-Sen- 1.21868

Kijun-Sen- 1.22025

EURUSD declined sharply to 1.21598 post FOMC meeting. The minutes for the FOMC meeting in Apr showed that some of the members are slightly hawkish and discussed QE tapering. "A number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," the minutes said. The US 10-year bond yields cooled off after hitting a high of 1.692%. DXY is holding above 90 levels. Any surge above 90.30 confirms intraday bullishness. EURUSD hits an intraday high of 1.22046 and is currently trading around 1.21936.

Technical:

On the higher side, near-term resistance is around 1.2260, and any breach above will take the pair to next level 1.2300/1.2400. The pair's near-term support is around 1.2180, violation below that level targets 1.21472 (200-H MA)/1.2100/1.2045 (100- day MA)/1.1980. The pair is holding above 200-H MA and trend reversal can happen if it closes below that level.

Indicator (Hourly chart)

CAM indicator –Slightly Bullish

Directional movement index –Neutral

It is good to buy on dips around 1.2180 with SL around 1.2120 for the TP of 1.2300.