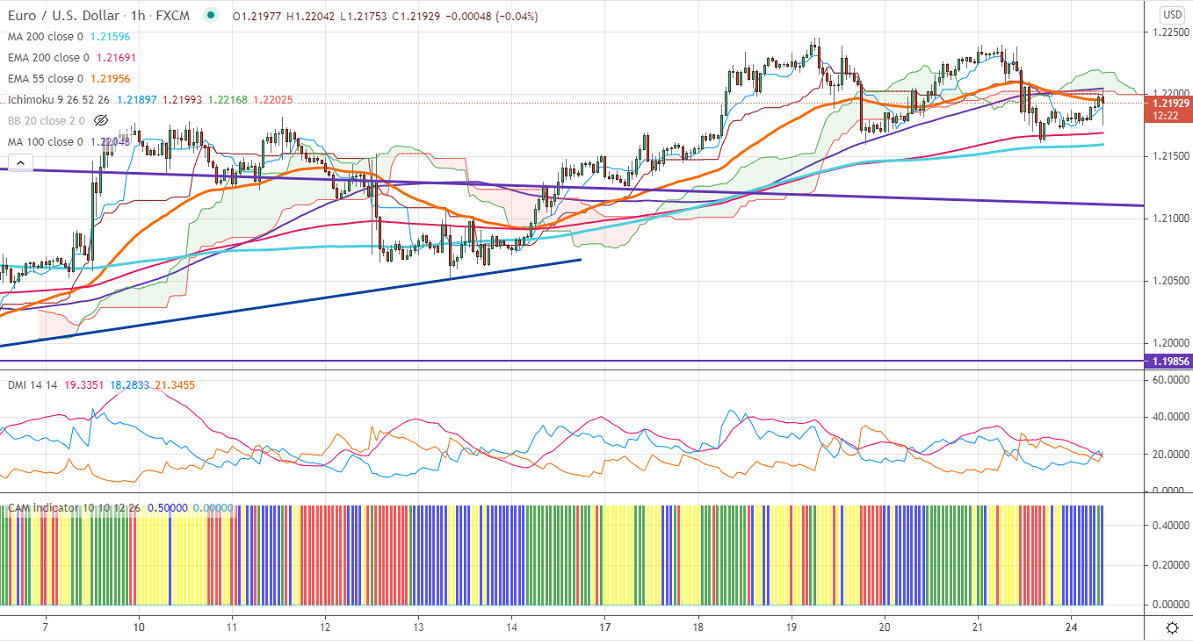

Ichimoku analysis (Hourly chart)

Tenken-Sen- 1.21897

Kijun-Sen- 1.21993

EURUSD has taken support near 200- H MA and jumped above 1.2200 level on declining US bond yields. The US 10-year bond yield lost more than 4.5% after forming a minor top around 1.705%. The upbeat flash manufacturing PMI and hawkish comments from Fed members on QE tapering are supporting the US dollar. The manufacturing PMI jumped to 61.5 in Apr vs an estimate of 60. The services PMI hits record high 70 points in May well above forecast 64.3.DXY is holding above 90 levels. Any surge above 90.30 confirms intraday bullishness. EURUSD hits a high of 1.22046 at the time of writing and is currently trading around 1.21936.

Technical:

On the higher side, near-term resistance is around 1.2260, and any violation above will take the pair to next level to1.2300/1.2400. The pair's near-term support is around 1.2150(200- H MA), a breach below that level targets 1.2100/1.2045 (100- day MA)/1.1980.

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to buy on dips around 1.2180 with SL around 1.2120 for the TP of 1.2300.