FxWirePro- EURUSD Daily outlook

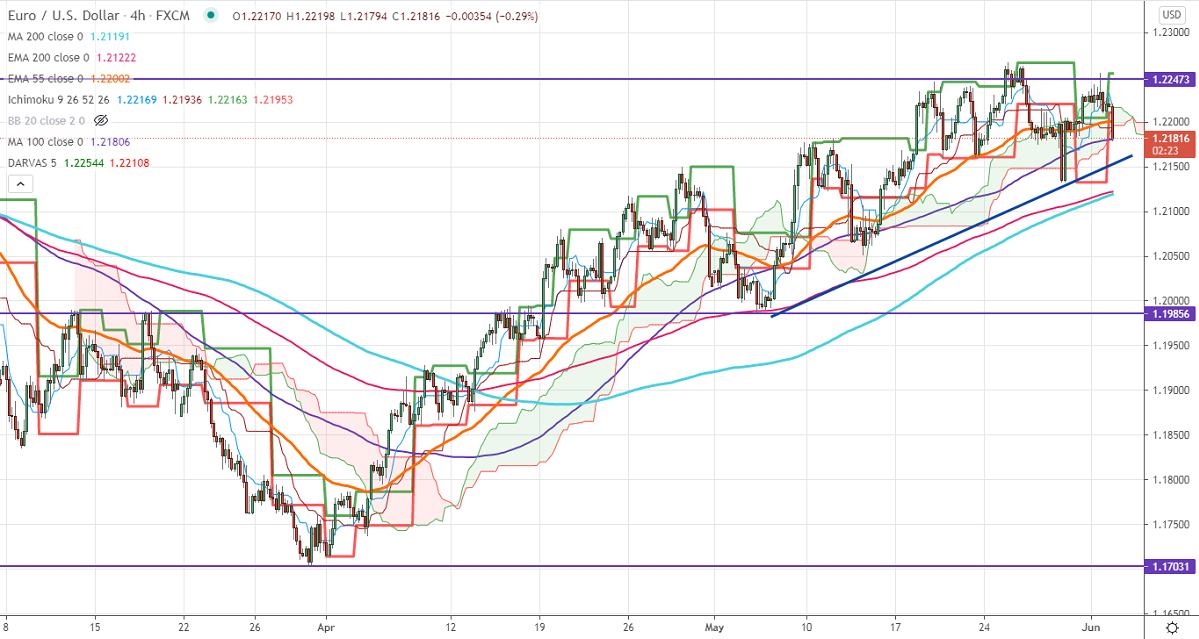

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.22326

Kijun-Sen- 1.21936

EURUSD has formed almost a double top around near 1.2260 and shown a minor sell-off. The upbeat US economic data and coronavirus concern is supporting the US dollar at higher levels. The US ISM manufacturing index rose to 61.2 in May compared to a forecast of 60. The construction spending rose 0.2% less than expected in Apr after surging 1% in Mar. DXY is holding above 90 levels; any breach above 90.50 confirms a short-term uptrend. The weaker than expected German retail sales are also dragging the pair further down. EURUSD hits an intraday low of 1.21834 and is currently trading around 1.21858.

Technical:

On the higher side, near-term resistance is around 1.22665, and any convincing breach above will take the pair to next level 1.2300/1.23485. The pair's near-term support is around 1.2150, violation below that level targets 1.2120/1.2070/1.20380 (100- day MA)/1.1980.

Indicator (4-hour chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to buy on dips an around 1.2150 with SL around 1.2115 for the TP of 1.2260.