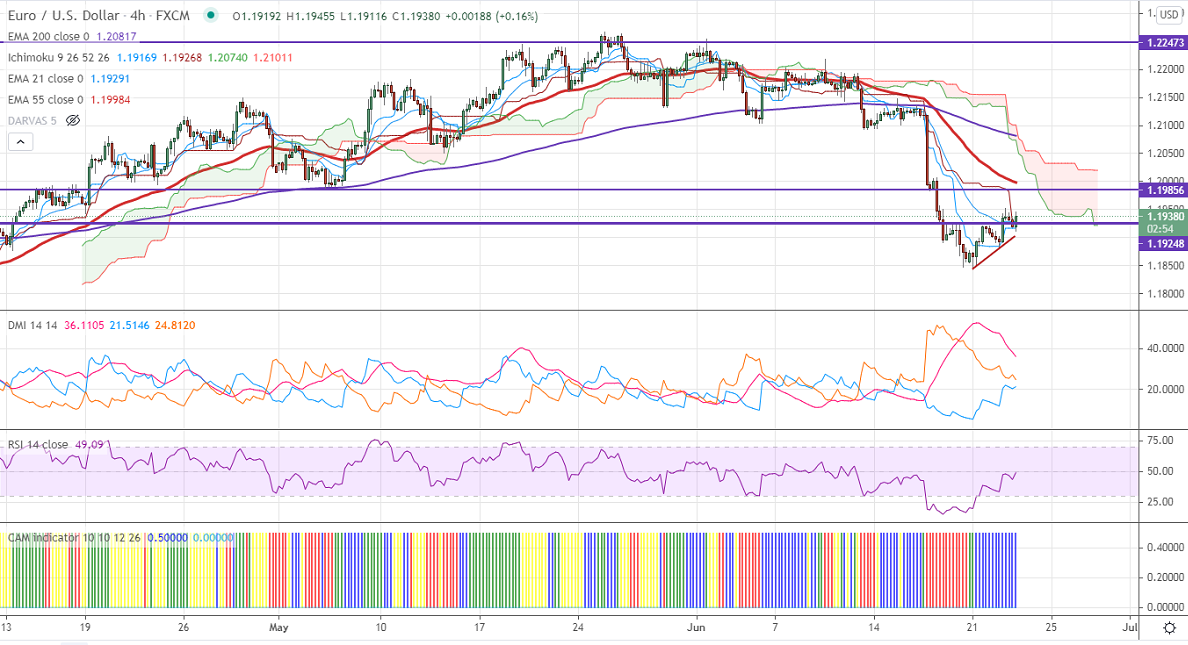

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.19181

Kijun-Sen- 1.19268

EURUSD has halted its two weeks of the bearish trend and shown a minor recovery. The slight dovish comments from Fed Chairman and upbeat Eurozone data are supporting the single currency at lower levels. Fed chairman said that the surge in inflation was mainly due to the reopening of the economy after the pandemic. This shows that there will not be a rate hike in the near term. The German flash manufacturing PMI came at 64.90 in June slightly better than the forecast of 63. The pair hits an intraday high of 1.19455 and is currently trading around 1.19371.

Technical:

On the higher side, near-term resistance is around 1.19530, and any convincing breach above will take the pair to next level 1.2000/ 1.2035 (200- day MA). The pair's near-term support is around 1.1880, break below targets 1.1840/1.1800.

Indicator (Daily chart)

CAM indicator- Slightly bullish

Directional movement index –Bearish

It is good to buy on dips around 1.19350-360 with SL around 1.1900 for the TP of 1.2040.