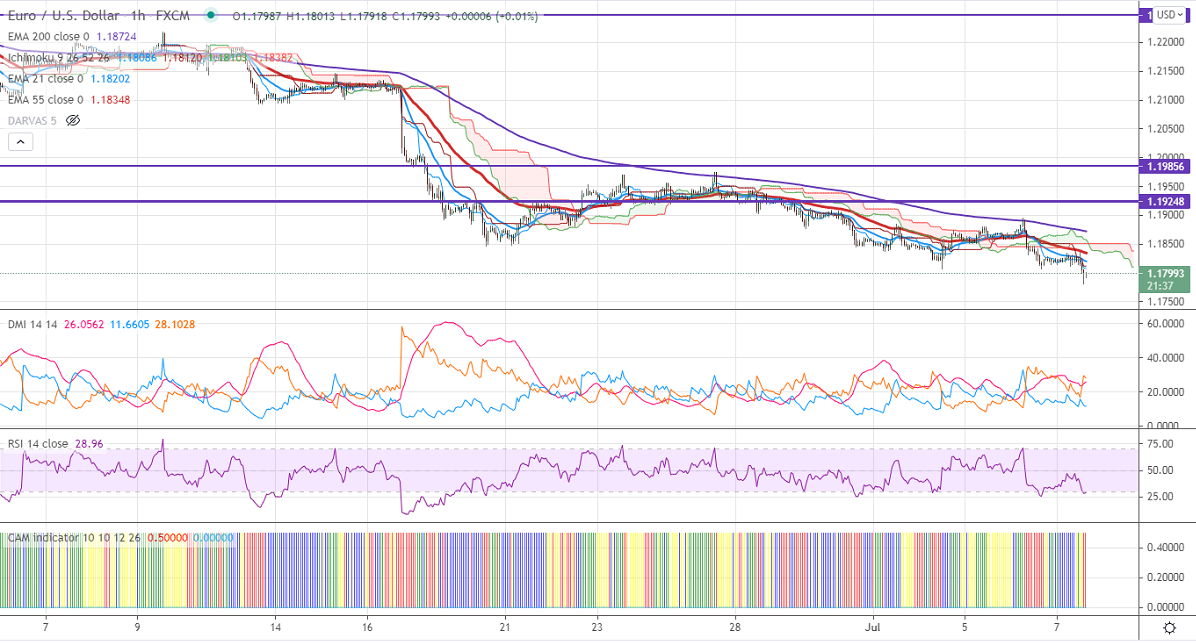

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.18086

Kijun-Sen- 1.18120

EURUSD is trading weak despite declining US bond yield. It has lost more than 12$% this week and holding below 200-day EMA. Markets eye US FOMC meeting minutes for further direction. DXY broken the previous week high after a long consolidation, a jump till 93 is possible. EURUSD hits an intraday low of 1.17813 and is currently trading around 1.17995.

Technical:

On the higher side, near-term resistance is around 1.18350, and any convincing breach above will take to the next level 1.1865/1.19070/1.1970. The pair's near-term support is at 1.1780, break below targets 1.1720.

Indicator (1-hour chart)

CAM indicator-Bearish

Directional movement index – bearish

It is good to sell on rallies around 1.1828-30 with SL around 1.1870 for the TP of 1.1720.