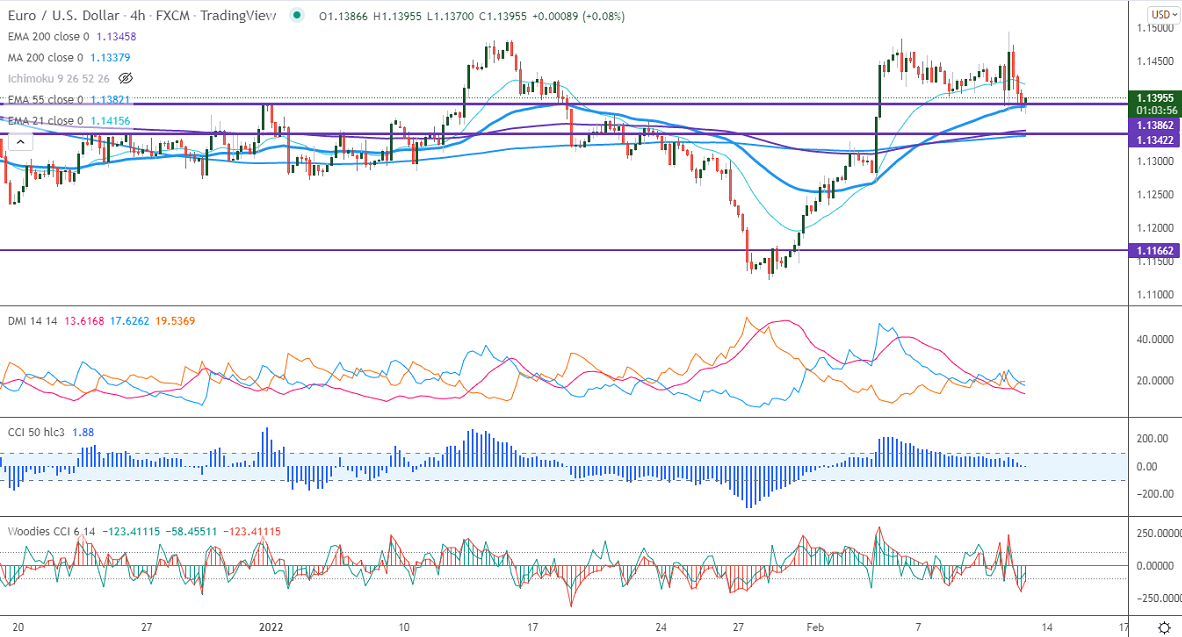

Intraday trend – Bearish

Major intraday Support– 1.1360

The pair showed a massive sell-off after upbeat US CPI data. . The January US CPI came at 7.5% YoY vs forecast of 7.3%, the highest level since Feb 1982. The US 10-year yield surged above 2% for the first time since Aug 2019 as the chance of aggressive rate hikes by the Fed increased after inflation data. The policy divergence between US Fed and ECB is putting pressure on the pair at higher levels. It hits an intraday high of 1.13700 and is currently trading around 1.13882.

Technical-

Any breach below 1.13700 confirms intraday bearishness. A dip till 1.1340/1.1300/1.1230 is possible.

The immediate resistance to be watched is 1.1435; any violation above will take the pair to 1.150/ 1.1580/1.1700.

Indicators (4-hour)

Directional movement index –Neutral

CCI (50) – Neutral

It is good to sell on rallies around 1.1408-10 with SL around 1.1460 for a TP of 1.1260.