EUR/USD declined slightly after mixed US economic data. It hits a intraday low of 1.04192 and currently trading around 1.04215.

The January 2025 PCE Price Index showed a 0.3% rise in the month, with the year-over-year rate slowing to 2.5% from 2.6% in December. Core PCE also increased 0.3% in the month and 2.6% in the year. Personal consumption expenditures fell by $30.7 billion (0.2%) in total, as goods spending fell while services spending rose. Inflation-adjusted spending fell by a significant 0.5%, the biggest in nearly four years. This information supports the Federal Reserve's move to stop interest rate increases, as prices are still above target but weakening. Chronic inflation still dampens the consumer's psyche, negatively affecting their ability to save and spend on discretionary products.

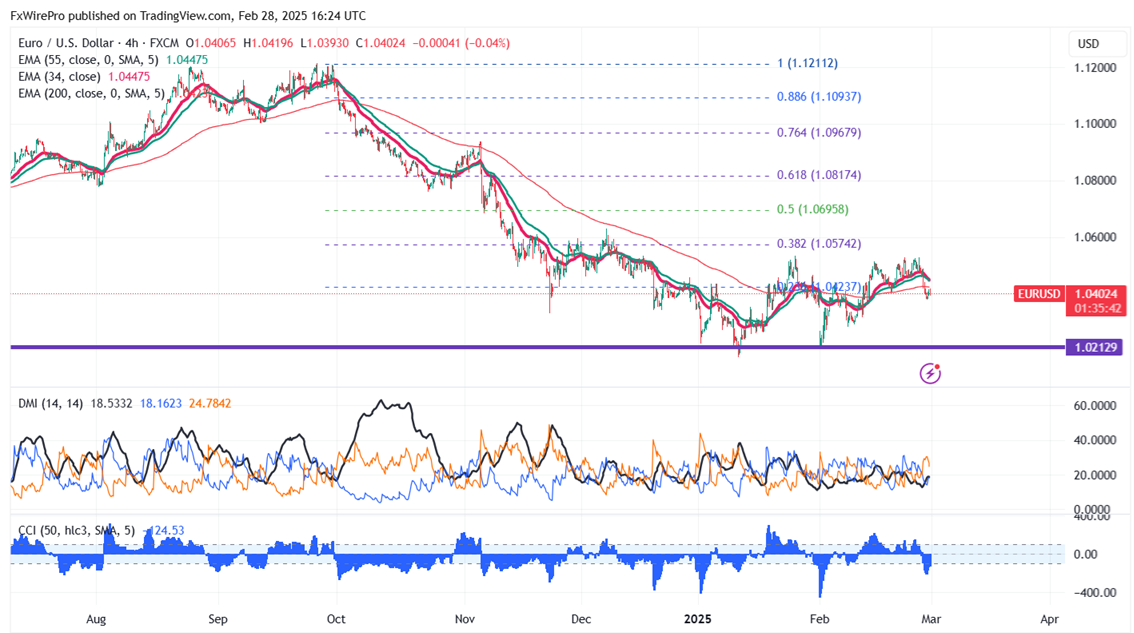

Technical Analysis of EUR/USD

The pair is holding below short and below THE long-term moving average in the 4-hour chart. Near-term resistance is seen at 1.0465; a break above this may push the pair to targets of 1.0500/1.0535/1.0575, and 1.0600/1.0660. Major bullish momentum is likely only if prices can break above 1.0660, where levels of 1.0700, 1.0760, and 1.0800 await. On the downside, support is seen at 1.0400 any violation below will drag the pair to 1.0360/1.0300/1.0220.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bearish

Average Directional Movement Index (ADX) - Neutral.

It is good to sell on rallies around 1.04350 with a stop-loss at 1.0500 for a target price of 1.0220.