EUR/USD pared most of its gains despite weak US economic data. It hits a intraday low of 1.12775 and currently trading around 1.12763.

For the week of April 26, 2025, US Unemployment Claims rose unexpectedly by 241,000, or 18,000 from the previous week, with the 4-week average at its highest since February 2025 and insured unemployment at its highest since November 2021, signaling a cooling labor market. Meanwhile, the US ISM Manufacturing PMI for April 2025 remained in contraction at 48.7, with weak new orders and ongoing workforce reductions, as well as further compounded by tariff uncertainty, even as the S&P Global PMI signaled narrow expansion.

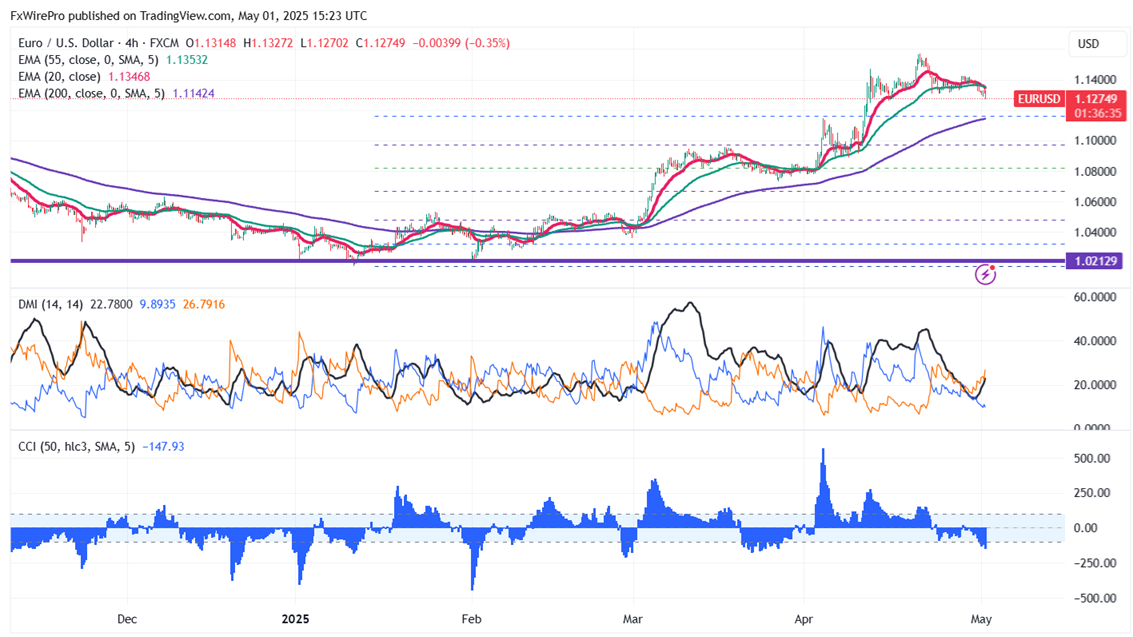

Technical Analysis of EUR/USD

The pair is holding above short and long term moving average in the 4-hour chart. Near-term resistance is seen at 1.1350; a break above this may push the pair to targets of 1.1380/1.1425/1.1450/1.1500/ 1.1570/1.1600. Major bullish momentum is likely only if prices are able to break above the 1.160 target 1.1660. On the downside, support is seen at 1.1270 any violation below will drag the pair to 1.1270/1.1240/1.1150/1.11000/1.10840/1.1000.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bearish

Average Directional Movement Index (ADX) - Bearish

It is good to buy on dips around 1.1300 with a stop-loss at 1.1245 for a target price of 1.160.