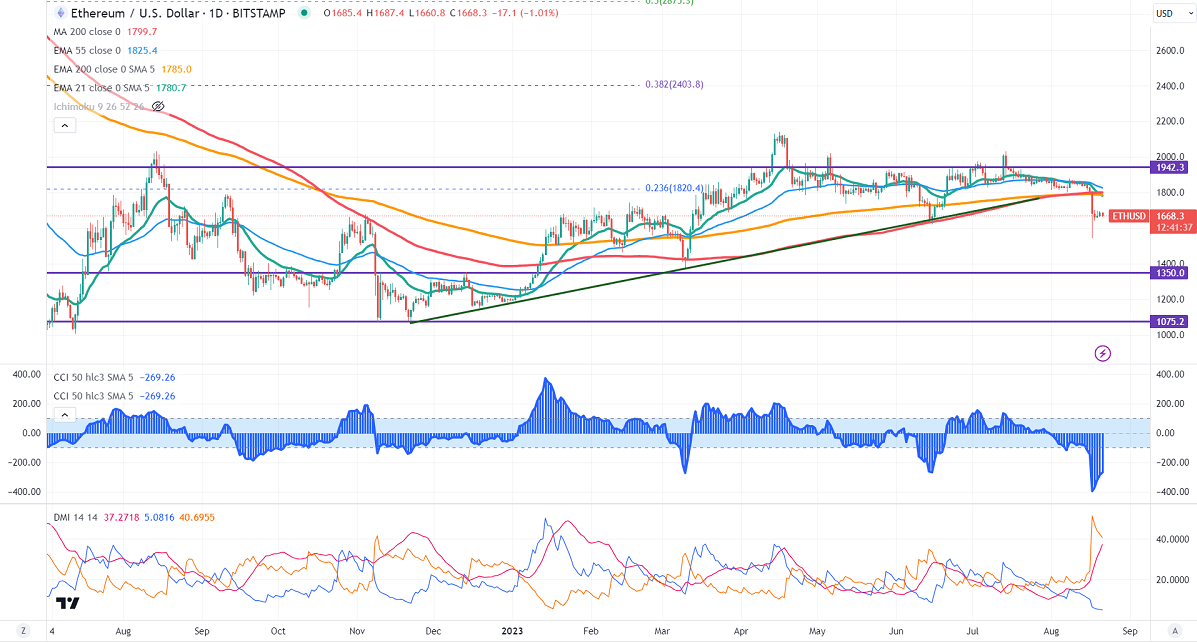

ETH prices showed a minor pullback after hitting a multi-week low.

It holds below the long-term moving average of $1786 (200-day EMA).

ETHUSD trading was weak and lost more than $400 following the footsteps of Bitcoin. The upbeat US retail sales and Philly Fed manufacturing index has increased the chance of another 25 bpbs rate by the Fed this year. It hits a low of $1542.60 and is currently trading around $1666.50.

Major economic data to watch this week

Aug 22nd, 2023, Existing home sales and Richmond manufacturing index (2:00 pm GMT)

Aug 23rd, 2023, German flash manufacturing and services PMI (7:30 am GMT)

UK flash manufacturing and services PMI (8:30 am GMT)

US flash manufacturing and services PMI (1:45 pm GMT)

Aug 24th, 2023, US Core durable goods order and unemployment claims (12:30 pm GMT)

Aug 25th, 2023, German IFO Business Climate (8:00 am GMT)

Jackson hole symposium Powell speech (2:05 pm GMT)

The bullish invalidation can happen if the pair closes below $1570. On the lower side, the near-term support is $1540. Any break below targets $1475/$1369/$1300. Significant downtrend if it breaks $800.

The immediate resistance stands at around $1800. Any breach above confirms a minor pullback. A jump to $1900/$1973/$2030 is possible. A surge past $2050 will take Ethereum to $2294/$2500.

It is good to buy on dips around $1500 with SL around $1365 for TP of $2000/$2400.