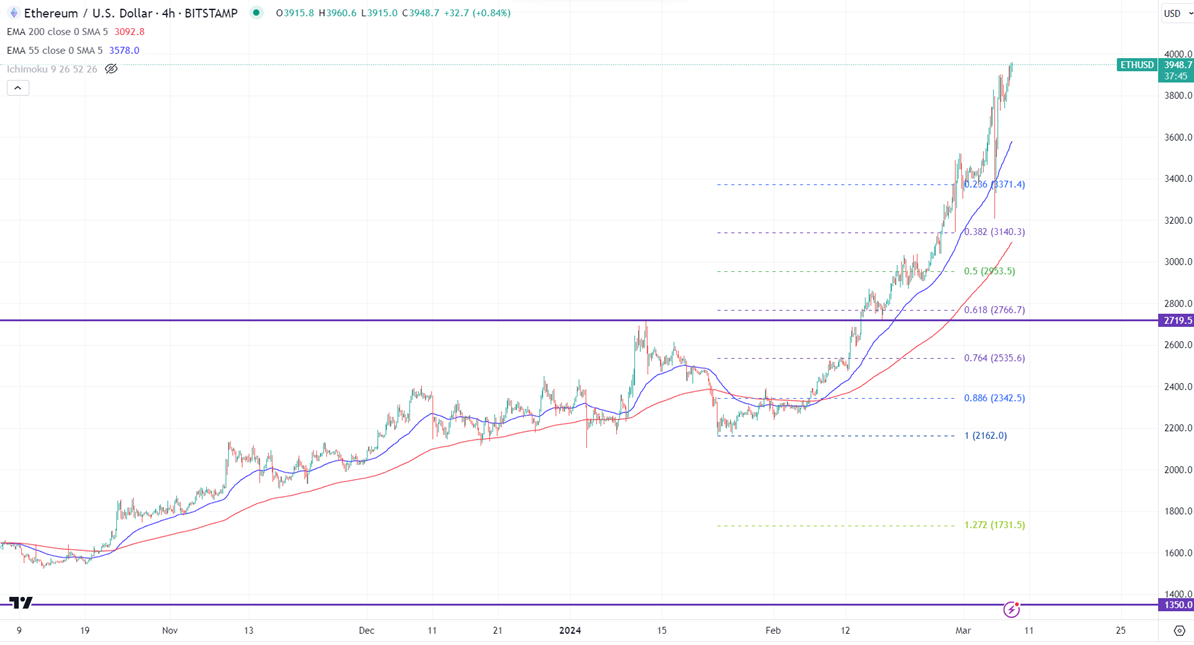

ETHUSD hits a fresh year high due to positive sentiment. It hit a high of $3960 yesterday and is currently trading around $3947.

The number of Ethereum staked increased to 31 million ETH for the first time in history. The transition from POW to POS after the launch of Decun will address the scalability issues.

The intraday bullishness is possible if it holds above $4000. On the higher side, the near-term resistance is $4000. Any significant jump above the target of $4350/$4800. Significant bullish continuation only above $4800.

The immediate support is around $3700. Any intraday break below will drag the pair to $3500/$3370/$3300/$3200. Any breach below $3200 confirms bearish continuation. A dip to $3080/$3000 is possible. A violation below $2700 will drag the Ethereum to $2500/$2300.

It is good to buy on dips around $3800 with SL around $3600 for TP of $4350.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary