ETHUSD pared some of its gains after strong US inflation data. It hit a low of $3413 at the time of writing and is currently trading around $3437.

US CPI surged to 3.5% y/y in Mar from 3.2% in Feb. Core CPI excluding food and energy rose 0.40% m/m vs. Forecast of 0.30%.

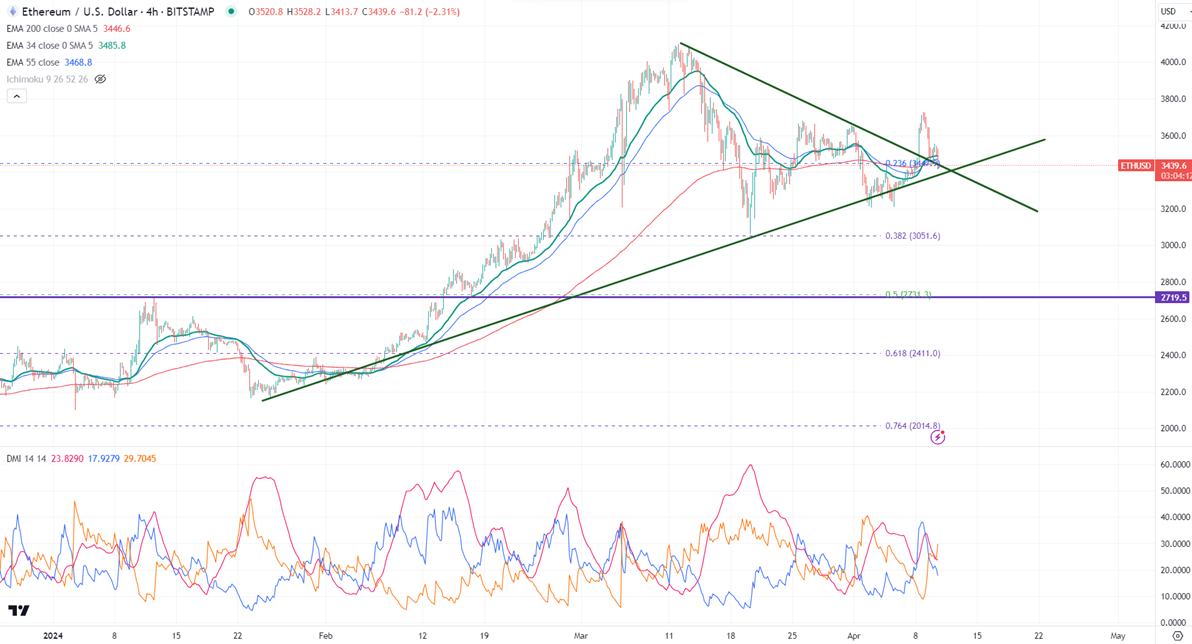

The intraday bullishness is possible if it holds above $3500. On the higher side, the near-term resistance is $3500. Any significant jump above the target is $3700/$3800/$4000. Significant bullish continuation only above $4800.

The immediate support is around $3400. Any breach below $3200 confirms bearish continuation. A dip to $3000/$2700 is possible. A violation below $2700 will drag the Ethereum to $2500/$2300.

It is good to buy on dips around $3400 with SL around $3200 for TP of $4000.