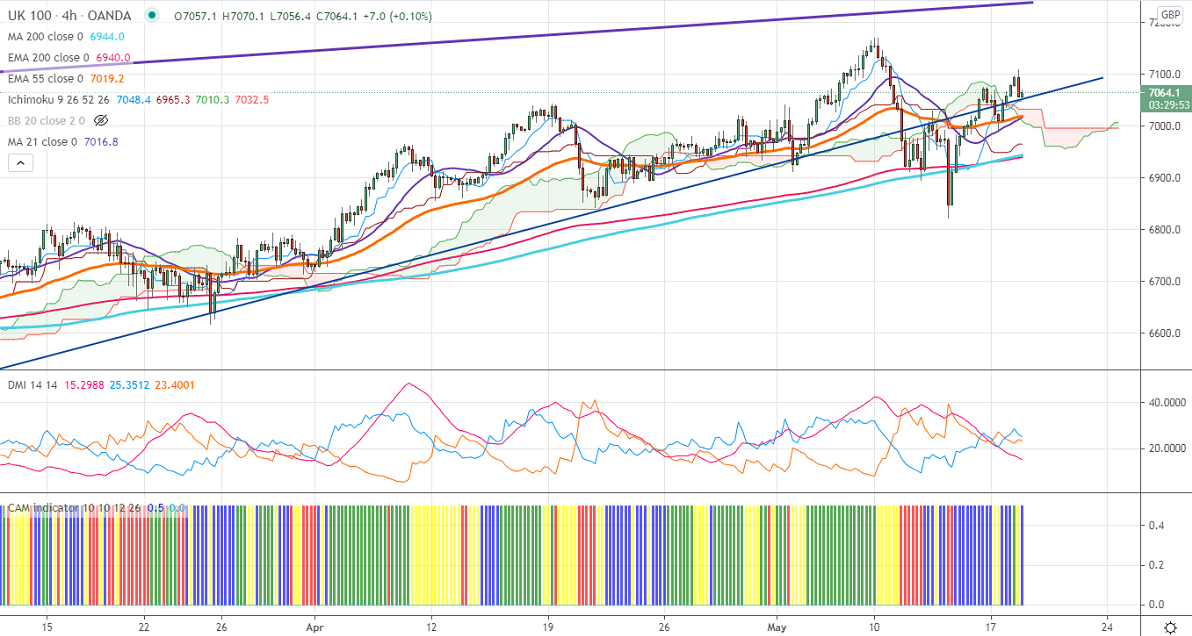

Ichimoku Analysis (4-hour chart)

Tenken-Sen- 7048

Kijun-Sen-6965

FTSE100 recovered sharply after hitting a low of 6822 on upbeat market sentiment. The decrease in coronavirus new cases and deaths in the United Kingdom is pushing the index higher. The UK government has eased restrictions yesterday. The European stocks are trading higher supported by dovish Fed members and upbeat UK jobs data. The Claimant count change came at -15.1K compared to a forecast of 25.6K and unemployment declined to 4.8% vs 4.9%. FTSE100 should break above channel resistance 7220 for further bullishness. The FTSE100 hits an intraday high of 7108 and currently trading around 7064.

The near-term resistance to be watched is 7120 any break above will take the index till 7170/7220. Significant bullish trend continuation only if it crosses 7200. On the lower side, near-term support is around 7020, and any violation below targets 6985/6941/6900/6820.

Indicator (Hourly chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies 7145-50 with SL around 7220 for the TP of 6820.