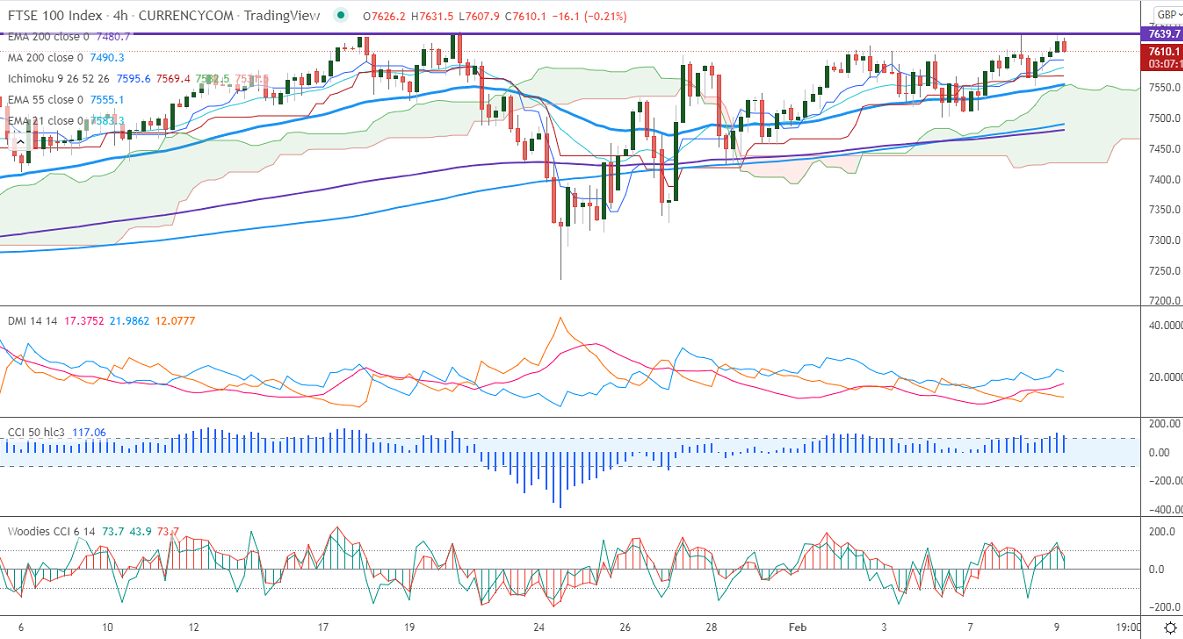

Ichimoku Analysis (4-hour chart)

Tenken-Sen- 7595

Kijun-Sen- 7569

FTSE100 continues to trade higher and hits a 2-year high on global stock market support. The jump was led by banking and oil shares. The surge in Pound sterling after BOE hawkish rate hike weighs on the FTSE index. The further upside is to be capped as UK economists predict higher inflation in 2022. It hits an intraday high of 7637 and is currently trading around 7612.50.

The near-term resistance to be watched is 7650 and any violation above will take the index till 7725/7800/7900. Significant trend continuation only if it crosses 8000.

The immediate support is around 7425, any indicative violation below targets 7330/7230/7130. Bearish continuation only if it breaks below 6970.

It is good to buy on dips around 7600 with SL around 7500 for the TP of 7950.