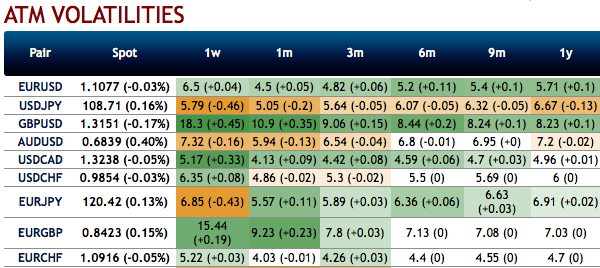

Amid low IV (implied volatility) environment, VXY Global heads into next year with the deepest cyclical undershoot on record, in excess of 3 % pts. The IVs of most of the FX pairs have been tepid, jerking in the range of 4-7% except cable and EURGBP.

The ultra-cheap vol valuations however need to be set in the context of less stressful global economic conditions next year. JPM baseline expectations of lukewarm moves from the big G3 FX, and the drip feed of USD strength in 2019 of the kind that erodes speculative interest in FX carry are other reasons to curb one's enthusiasm for a V-shaped vol rebound.

The path of least resistance to higher FX vol next year runs through politics (US/China, US elections), not economics.

Option themes for 2020:

1) The favoring EM vol over DM vol;

2) The betting on Euro strength through contained upside structures / RVs;

3) 2020 US elections: long USDCHF forward volatility over the Democratic primaries;

4) The systematic shorts in AUD and JPY risk- reversals as their risk-sensitivities have regime shifted lower;

5) Activate longs in GBPUSD 1Y1Y forward volatility for renewed back-ended Brexit disruption; and

6) The model-based mean-reversion pair selections (NOK vs. SEK, PLN vs. HUF). Courtesy: JPM & Saxobank

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields