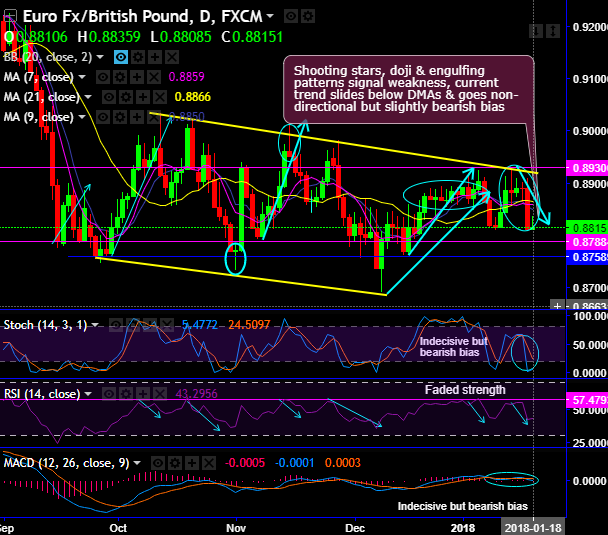

On daily plotting of EURGBP, shooting stars, doji & engulfing patterns signal weakness, current trend slides below DMAs & goes non-directional but slightly bearish bias. The minor trend has been oscillating between sloping channels.

Shooting stars have occurred near channel resistance, the bearish engulfing pattern has occurred at 0.8810 levels to hamper the momentum in previous rallies.

As a result, the current trend has slid below DMAs yet again, these bearish sentiments are backed by both leading oscillators but lagging indicators are indecisive.

For now, the stiff resistance is observed at 0.8930 and the strong supports are at 0.8788 and 0.8758 levels. While in the medium term, a range between 0.8250 and 0.9032 is expected.

On a broader perspective, the prices are consolidating at around the higher-point of the above-stated range (the current 0.8816) even though the minor trend studies remain a little “overbought”, warning the upside is limited in the near term. We are watching the cross in conjunction with the key levels in the legs highlighted above.

Leading oscillators have been little indecisive, even though RSI shows faded strength on monthly terms.

In long-term, amid struggling for bullish momentum and the occurrence of the bearish engulfing pattern at 0.8814 levels, we can’t afford to risk a re-test and break of 0.9415 in the first instance. The decline through 0.88 and 0.87 areas decreased that risk, leaving us in the middle of the medium-term range.

Contemplating above shot term technical rationale, you can place trades to construct tunnel binary options spreads using upper strikes at 0.8859 and lower strikes at 0.8788 levels, these leveraged instruments are likely to fetch magnified effects in payoff structure as long as underlying spot FX keeps dipping.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 50 (which is bullish), while hourly GBP spot index was at 147 (highly bullish) while articulating at 12:03 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: