Aussie prints upbeat numbers in unemployment at 5.8% in Feb, reduced from previous 6%, whereas the jobless claims in U.K. remained unchanged.

While last recent NAB's business confidence survey in Australia remains at 3 that indicates economic health - businesses react quickly to market conditions, so we think prevailing economic conditions in Australia is on upper hand than U.K.

On the contrary, trade balance in U.K. has expanded from previous -9.9B to the current -10.3B in line with the forecasts.

With resultant effects, the GBPAUD cross is anticipated to depreciate further, most likely towards 1.83 levels.

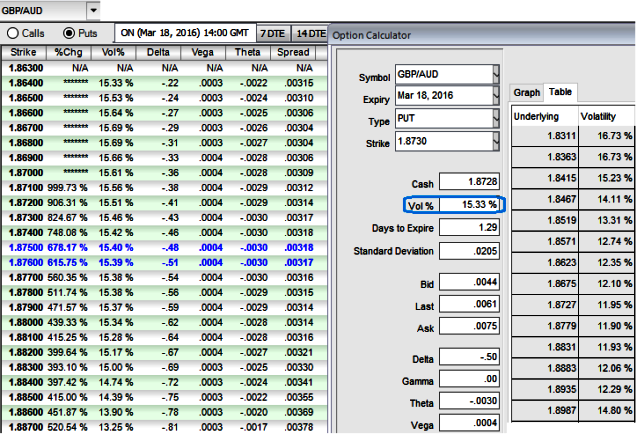

Approximately about three from now BoE's rate decision would be released which is likely to remain unchanged but the potential Brexit event keeps adding more pressures on sterling, but refer above diagram for 1D IVs in FX options due to the U.K's interest rate speculations.

The pair has been very well reacting as per earlier analysis and we maintain our medium term targets at 1.83 levels.

Since OTC markets seem to be highly volatile with extremely bearish environment, and IVs for 1M contracts are expected to fade away (at around 10.80%). This would be a good news for short term option writers contemplating the prevailing bearish environment but more number of longs in ATM delta puts would ensure the reasonable probabilities in underlying exposures.

To factor in the weakness in this pair as we could see reasonable IVs even in next 1-3m expiries, we recommend capitalizing more on bearish signals and the IV factor in long term by employing OTM longs matching with ATM longs to construct back spreads that likely to fetch positive cash flows.

Please be sure that a large move in the underlying should be allocated with longer tenor (targets set at 1.83 levels) and can be withstood without losing any money. This should be of greater concern than doing the spread for reducing debit.

So, here goes the strategy this way, Go long in 2 lots 1M ATM -0.50 delta puts, long in 2M (1%) OTM -0.35 delta put, and simultaneously short 2W (1%) ITM shorts, the spread is to be executed in the ratio of 3:1with net delta at around -0.70

The delta of the strategy is at 70%, which means there is more likelihood of expiring ITM, since we are certain about our research, we preferred 1 lots of extra long of slightly OTM strikes in our Put Ratio Back Spread.