It is urged that our readers to square off all bearish positions and for now convert the same into strap on hedging mindset as the pair to nudge above to hang around 2.1809 levels which is a trend line support and it uses that levels as strong support, form there onwards to head towards 2.2085. Since the long term trend has been bullish and the technical signals have been favoring this healthy uptrend, we reckon the option strap that is more of customized version of combination suitable for more bullish sentiments.

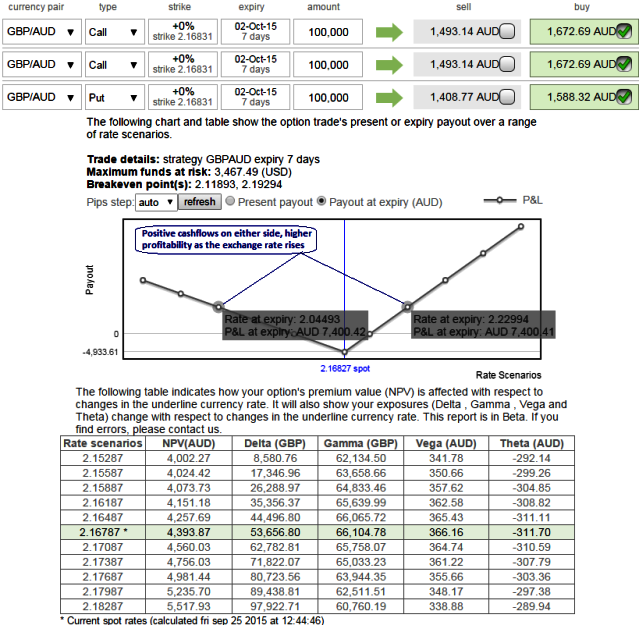

With the above technical reasoning, unlike spreads, combinations allow adding both calls and puts at a time so as to suit the uptrend as we don't want to argue with the trends no matter what.. So, buy 15D 1 lot of At The Money -0.49 delta put option and simultaneously buy 2 lots of 15D At The Money 0.51 delta call options. It involves buying a number of ATM puts and double the number of calls. In buying a second call, the strategy retains its preference for high volatility but now with a more bullish slant.

Hence, any hedger or trader who considers above price targets and believes GBPAUD is more likely to surge upside can go for this strategy. Maximum returns can be achievable when the underlying exchange rate makes a strong move either upwards or downwards at expiration but with greater gains to be made with an upward move as the more buying sentiments are seen on technical charts. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

FxWirePro: GBP/AUD option straps serve hedging motive

Friday, September 25, 2015 9:38 AM UTC

Editor's Picks

- Market Data

Most Popular