• GBP/AUD declined on Wednesday as soft US job data and Powell's cautious stance on rate cuts fuelled selling in the pair.

•Fed Chair Powell warned that while progress in reducing inflation is possible, it's not guaranteed. However, he emphasized that potential interest rate cuts are still under consideration.

•US ADP employment report indicates that companies hired fewer workers than anticipated. The February ADP employment change in the U.S. increased by 140,000, falling short of the expected 150,000.

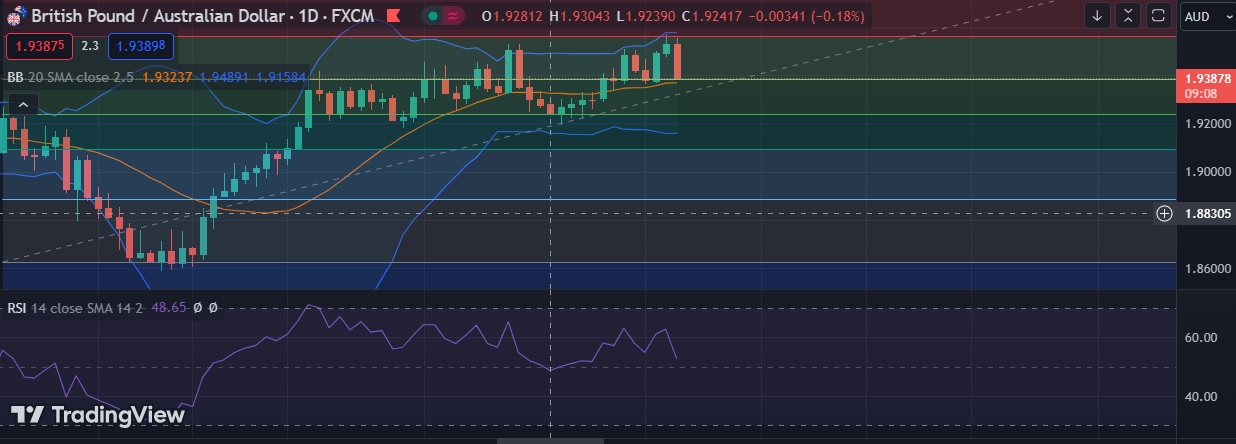

• The pair dropped to test 1.9381(38.2% fib ). A break under would unmask 1.9300 level .

•Immediate resistance is located at 1.9545(23.6%fib ) , any close above will push the pair towards 1.9576 (Higher BB).

• Immediate support is seen at 1.9381(38.2% fib ) and break below could take the pair towards 1.9285(Feb 7th low ).

Recommendation: Good to sell around 1.9400, with stop loss of 1.9500 and target price of 1.9320.