Dear readers,

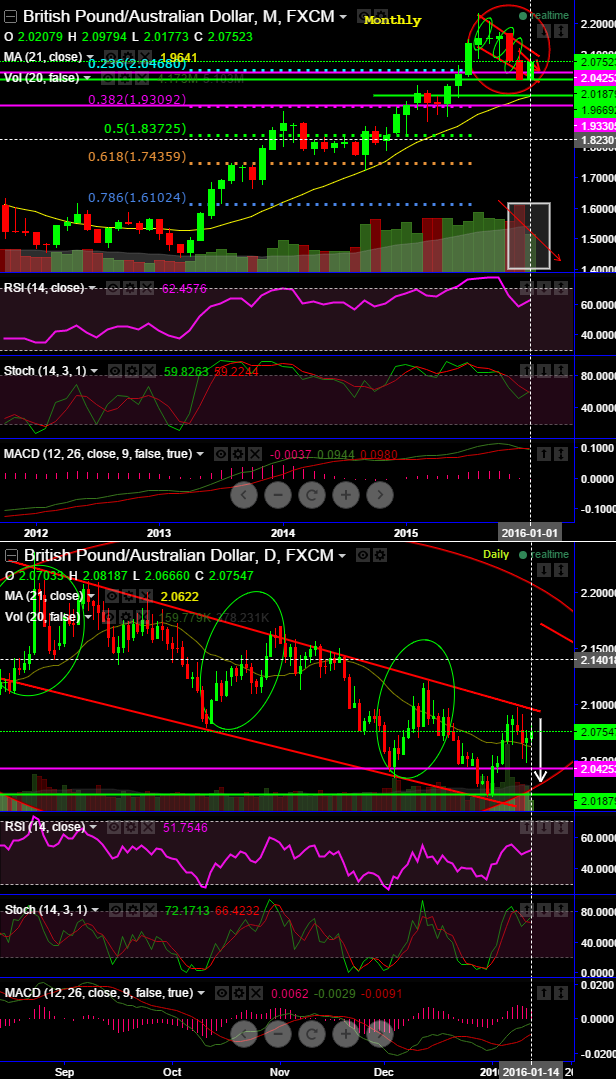

Nothing much to emphasize on this pair as the pair has never changed its price and volume behavior during its travel between the sloping channel as you can see from the daily charts. It is not a magic but sheer research.

Please refer below link for our recent derivatives strategy wherein we had explicitly mentioned which instruments to use with how much time frames:

http://www.econotimes.com/FxWirepro-GBP-AUD-diagonal-straps-to-monitor-puzzling-swings-on-speculative-basis-137911

Yes, it has acted as per the whim fancies of swings traders to ensure the support resistance levels to remain within the range of sloping channel.

If you evaluate the prevailing price of GBPAUD (spot FX 2.0735) with the price on 5th October (2.1571) we would certainly arrive with two important points.

Primarily, one would be assured with recent upswings were exhausted as a resultant effects of channel resistance. So it has taken a resistance exactly at 2.0979 (highs of 11th Jan).

Additionally, the current bears are insanely in love with the prevailing downtrend lasted for last six months or so and no doubt it is still available in long term.

On monthly perspective, although the pair has taken supports at 2.0207 it is still hovering around 23.6% Fibonacci retracements levels, there exists the genuine perplexing scenario.

For now, volumes are fading away at that stage with rising price with leading indicators to converge falling prices, any which ways a keen observation on closing basis would be accounted.

As a result, our long term bearish stance would prevail for now since it has just made a 23.6% retracement (pink horizontal lines) when pair made highs of 2.2372 from 1.4410 during the process of saucer formation that we saw in our recent analysis (see above link), we continue to believe it is on the retracing mood.

FxWirePro: GBP/AUD slumps responding as per swing traders’ whim fancies – moving accurately in sloping channel

Thursday, January 14, 2016 8:50 AM UTC

Editor's Picks

- Market Data

Most Popular

9