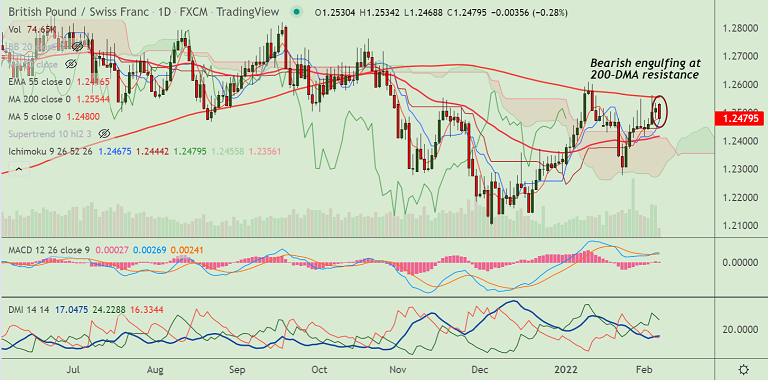

Chart - Courtesy Trading View

Spot Analysis:

GBP/CHF was trading 0.21% lower on the day at 1.2488 at around 16:00 GMT

Previous Week's High/ Low: 1.2563/ 1.2416

Previous Session's High/ Low: 1.2535/ 1.2478

Technical Analysis:

- GBP/CHF pauses upside shy of 200-DMA resistance

- Bearish engulfing candlestick pattern on the daily candle raises scope for downside

- RSI has turned South, but holds above the 50 mark, Stochs are biased higher

- GMMA indicator shows major and minor trend are bullish

Major Support and Resistance Levels:

Support - 1.2455 (20-DMA), Resistance - 1.2554 (200-DMA)

Summary: GBP/CHF keeps scope for weakness. Watch out for close below 5-DMA for further downside.